Game theory and its applications to Digital Currency Mining

The past decade has brought with it new innovations in the digital world, and one of these innovations is digital currencies, like Bitcoin, Etherium, Litecoin, and many others. The concept of mining is essential to these large digital currencies, and Arvind Narayanan, an assistant professor of computer science at Princeton, believes that Game Theory concepts can be used to make money in mining, while even hurting competitor miners in the process.

The author starts out by defining that a mining pool is a “group of individual miners that pool their computing power as well as their rewards together.” He also states that pools could manipulate one another to selfishly gain more rewards. This is similar to some of the ideas on game theory we have touched on in class where there was a “playing honestly” choice and a “cheating” choice.

In order to analyze this specific case we need to define a couple more terms. Miner pools have power, in the sense that they control a certain fraction of the digital currency network. Miner pools also can send and use shares. Shares are defined as proofs of work and are used to decide how much reward each pool receives. (I.E. if you submit half of the shares then you get half of the rewards) The last important term to define is a block. Blocks are files that contain data pertaining to the digital network, like past transactions.

The author defined a couple of rules to follow as seen below:

- A pool’s revenues in any period are proportional to the number of currency blocks that its members mine, measured as a fraction of the total blocks mined in that period.

- A miner’s rewards are proportional to the number of “shares” submitted, as a fraction of the total shares submitted by all members of that pool.

- Miners can easily create numerous pseudo-identities (“sybils”), each contributing a very small amount of mining power. Therefore pools can’t easily detect if a miner is withholding valid blocks (and can’t punish a miner for doing so).

Narayanan, had the idea to look at this manipulation of different users with the following properties.

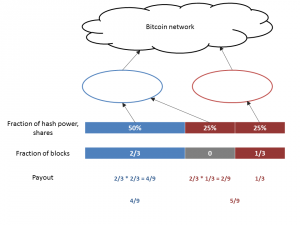

– We are given 2 large pools (the blue pool and the red pool)

– Each pool has 50% of the power in the digital currency network

– Each pool has access to the same number of Blocks and Shares (for simplicity)

Now say the red pool decided it would send half its shares over to the blue pool. Remember the number of shares is what determines the rewards. In addition, the red pool hides half of its blocks. This would cause the following result.

By moving some of the red pool’s shares into the blue pool the payout changed from an even 50%:50% to blue pool members getting 4/9 of the payout and red pool members getting 5/9 of the payout. Since this scenario is symmetric if blue decided to play unfairly like this its members would get 5/9 of the payout. Now we could also ask the question of what happens if both players decided to play this unfair strategy? Well both players would end up splitting the rewards 50%:50% because this would be a very symmetric outcome. In addition, if both players didn’t play unfairly and used their shares for their own respective pools you would also get a 50%:50% split. However, playing fairly would produce a better of the two outputs because both pools playing unfairly would result in a slower network that wouldn’t be able to gain as many rewards as efficiently.

In total, this scenario is extremely similar to some of the payoff matrices that we’ve studied in this course. If one player cheats then he gets more of the rewards, but if both cheat then they are both harmed.

https://freedom-to-tinker.com/blog/randomwalker/consensus-in-bitcoin-one-system-many-models/