Pump and Dump Networks

“Pump and dump” stock market scams have gained notoriety over the past 30 years or so: an individual or an organized group claims to have insider knowledge of a microcap stock (also known as penny stocks) and spreads falsified and baseless information concerning the stock’s imminent rapid growth. This increases the stock price dramatically within a short time frame due to increased demand (“pumping”), following which the scammers sell their shares for massive profits (“dumping”) and leaving the losses to those who blindly followed them looking for a quick buck. Take Jonathan Lebed as an example, a 15 year old in the 1990s with a little too much time on his hands: Lebed bought shares of a number of penny stocks, and then spread positive information about these stocks across message boards on the internet. After the prices of his stocks increased, he would dump his shares and reap the rewards while his followers were left holding the bag. He was later ordered to pay a fraction of his gains as restitution but never admitted to any wrongdoing.

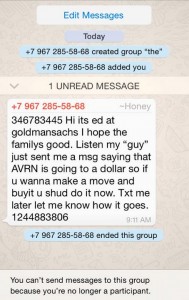

Recently, news of a novel pump and dump scam over the popular messaging app WhatsApp has come to light. A digital company called Avra was the target company this time around: thousands of WhatsApp users received messages from “Avra insiders” such as “Jack from Morgan Stanley,” kindly advising them that Avra was in for a big move. Naturally, many recipients of these messages fell for the scam, as illustrated by Avra’s swift jump in share price from $0.11 to $1.26 at the height of the scam.

The internet, and now messaging platforms like WhatsApp, allow rapid dissemination of such falsified information. The power in networks is apparent, as not only is it easier than ever for the scammers to spread misinformation, but also those on the receiving end of these messages will tell their friends about a new “hot stock tip” they came across, who will subsequently tell their friends the same, and so on. This is the “network effect” in full force, bolstered by the convenient and instant channel of communication between users. Similarly, other investors might notice the share price increasing rapidly and believe that others have information they don’t have, leading them to buy shares as well. This is a prime example of information cascade, where individuals tend to follow a crowd and potentially disregard rationality because they believe others are in on better information than themselves. WhatsApp being a social platform allows the cascading effect complete opportunity to take hold, where even just a few adopters can help spread the news of Avra’s success much like a biological epidemic. So, for any readers looking to make a quick buck, there has never been a better time to leverage the inherent power in networks.

Source: http://www.cbsnews.com/news/whatsapp-users-get-played-in-pump-and-dump-scheme/

Additional resources:

Example Avra message. Avra’s share price.