Oil Production Freeze & Game Theory

The article, “Game Theory at Its Finest: Why Oil Production Freezes Won’t Happen,” is particularly interesting because it uses game theory to understand the ‘connectedness’ of a system that involves social, natural and technological components – the oil industry. With oil around $45 dollars per barrel, it is interesting to assess the interconnected behaviors of oil producers in a low-price commodity environment.

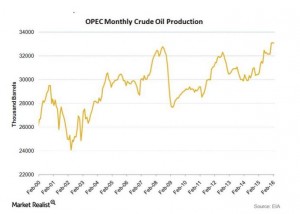

OPEC, an oil-producing oligopoly responsible for 43% of the world’s oil production, was formed to coordinate oil production between member countries leading to the stabilization of oil markets. However, as the author points out, individual oil-producing countries have an incentive to disobey any quota that may be put in place to cap oil production, which in turn has long-term negative consequences for oil-producers and OPEC’s oil market stabilization initiative alike.

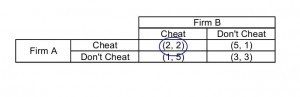

As you can see in the model above, the cartel countries would benefit more should all member nations abstain from cheating. The obvious question is: If oil producing countries can collectively experience greater economic gain by committing to oil production caps, why then are countries maximizing oil production causing a supply glut? If every country produces within the limitations of the quota, but one country overproduces, the cheating country will realize a greater economic gain because they simply have more oil to sell at the given market price. In practice, firms do not know the true behaviors of other oil producing countries within OPEC. Therefore, by choosing not to cheat a country risks economic loss and loss of market share because it is unknown whether or not other countries will also comply with OPEC production restrictions. As a result, the dominant strategy in this game is to cheat. This is a classic example of a ‘prisoner’s dilemma’ situation; two completely ‘rational’ countries within OPEC will not cooperate with restrictions because of their own self-interest, even though it appears it is in their best interest to cooperate.

To reiterate, the risk of not cheating outweighs the economic gain of following production quotas, and oil production has continued to rise steadily as a result. By introducing a disincentive for overproduction, in the form of a fine, for example, perhaps the added economic gain for disobeying OPEC’s quota would disappear and behaviors of individual countries would become more predictable, leading to a more efficient equilibrium in the above model.

http://seekingalpha.com/article/4004241-game-theory-finest-oil-production-freezes-happen