Game Theory in the Failure of OPEC

OPEC is an oil cartel made up of 14 countries who collectively control about one-third of global oil production. OPEC influences oil prices by agreeing to limit their oil production and therefore reducing oil supply in the global market. In the past months, Saudi Arabia has flooded the market in an attempt to protect its market share against the surge in U.S. shale oil, leading to excess supply and declining oil prices. The next OPEC meeting will take place in Algeria on September 26-28. Two speculated possible outcomes of the meeting are: a production freeze and a cut in production.

Both a freeze and a cut in production have the same goal – lower supply in order to raise prices. A freeze in production would be the most effective way of stabilizing the oil market, as told by Alexander Novak, the Russian energy minister. It entails stopping oil production at the current level (agreeing to avoid pumping out more and more oil). Meanwhile, cutting production would causes prices to surge if successful, according to Capital Economics’ Pugh. It entails all of the countries in OPEC agreeing to restrict their production drastically.

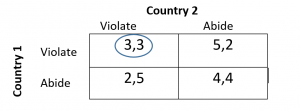

In both cases, a situation similar to the Prisoner’s Dilemma is created – if one country violates the agreement while the other abides, prices stay low and the country that violated the agreement benefits by selling more oil while the other has to sell the agreed amount of oil at a lower price. If both violate, output remains high and prices remain low. If both abide, prices climb and both players profit. The following chart portrays the possible outcomes:

According to Game Theory, each country will make the choice that is most beneficial for themselves independent of the other country’s strategy. In this case, both countries have a dominant strategy – violate the agreement – in which their own outcome is greater regardless of the strategy of the other country. Therefore, Game Theory implies that the countries in OPEC will make the choice that results in the lower outcome for both countries. Meanwhile, the most optimal outcome would occur if all of the countries abided by the agreement and limited production. Therefore, it is unlikely for a freeze or cut in production to occur even if the countries agree to do so at the Algeria meetings.

Links: http://www.investing.com/analysis/3-components-of-the-case-for-higher-oil-prices-200150619

http://oilprice.com/Energy/Energy-General/Four-Possible-Outcomes-Of-The-OPEC-Meeting.html