The Prisoner’s Dilemma in Oil Production

Game Theory lives in everyday life. We have seen examples of it in international relations, the market, nature and now in oil production. A recent article published in Seeking Alpha, a crowd-sourced content service for financial markets, reveals how the prisoner’s dilemma has contributed to the low oil prices that has hurt the economies of countries that depend on oil revenue. This article shows how some of the countries that have suffered most from loss of oil revenue have actually contributed to the problem. This serves as a great example of how the prisoners dilemma leads “rational” individuals, in this case nations, to not cooperate, even when it appears that it is in their best interests to do so.

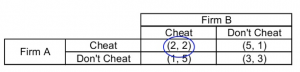

In summary, OPEC, an organization of petroleum exporting countries that in total account for 43% of global oil production, and Russia have been holding meeting on how to stabilize the oil market and bring the price of oil back up. Ironically, these meetings have so far only resulted in increased oil production, which lowers oil prices. The author attributes this outcome to the prisoner’s dilemma. The chart below helps illustrate this.

Firm A and Firm B can represent any two oil producing nations. The author chooses Saudi Arabia and Russia. Nations decide how much oil to produce. They are however restricted by production quotas. The countries know that if they abide by their production quotas, but another country overproduces, the country that overproduces realizes a greater economic gain. This is why, in the matrix, in the two cases where one nation cheats and the other does not, the nation that cheats sees the larger gain (see the bottom left and upper right quadrants). This creates an incentive to cheat. And from the matrix above, we see that cheating is a strictly dominant strategy. Cheating gives a nation the best choice regardless of what the other nation chooses. Even though the nations as a whole would benefit more if there were no cheaters, the risk of not cheating and receiving a lower economic outcome than the country that cheats is what makes this a “prisoner’s dilemma”.

This results in countries ignoring quotas and overproducing, which in turn decreases oil prices and reduces revenue. I think this is an interesting real-world example of the prisoner’s dilemma. The author does a good job breaking down the problem so that even someone who is unfamiliar with Game Theory could understand it.

Resource: http://seekingalpha.com/article/4004241-game-theory-finest-oil-production-freezes-happen