Oligopoly and Game Theory

Since the oil collapse in fall of 2014, US and Russia have been engaging in talks on how stabilize the oil market and ultimately drive the prices higher. Each meeting produces the same result, which is to boost oil production and thus naturally lowering the oil prices. In the oil industry, cartel is an association of manufacturers or suppliers with the purpose of maintaining prices at a high level and restricting competition. Countries can choose how much oil they want to produce based on the market prices and available supply to maximize their profits but since there is a cartel, oil production is capped. I find this interesting because this oligopoly situation can be analyzed using game theory that we have learned in class.

Oligopoly as a market structure is distinctly different from other market forms. The foremost characteristic of oligopoly is interdependence of the various firms in the decision making. This fact is recognized by all the firms in an oligopolistic industry. If a small number of sizeable firms constitute an industry and one of these firms starts advertising campaign on big scale or designs a new model of the product which immediately captures the market, it will surely provoke countermoves on the part of rival firms in the industry. In oligopoly situation, each firm has to stick to its price. If any firm tries to reduce its price, the rival firm will retaliate by a higher reduction in their prices. This will lead to a situation of price war which benefits none. On the other hand, if any firm increases its price with a view to increase its profits; the other rival firm will not follow the same. Hence no firm would like to reduce the price or to increase the price. The price rigidity will take place. However, companies like to increase their profits and beat the competition so this is where game theory comes into play.

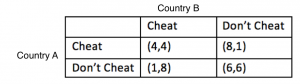

Let’s say both country A and country B are in competition with each other. If country A decides to cheat but country B obeys the production limits, then country A will realize greater economic gain. Same goes for country B if it decides to cheat but country A stays the same. More importantly, the dominant strategy of both countries is to cheat as it always is in oligopoly. This is similar to the prisoner’s dilemma we have learned in class. Just like in prisoner’s dilemma, both countries can choose to cheat which is better off for both the country and cartel, but under rational play of the game for both of the countries, it is very hard for them to achieve this outcome not knowing what the other country is going to do. Instead, they end up with an outcome that is worse for both of them. This is what happens between OPEC producing countries; countries will ignore their production quotas and flood the market with as much oil as possible.

To learn more about oligopoly markets click here

To access the online source click here