Why you may not want to be in the stock market post US election

Starting with the most disturbing recent news, Russian Government officials have been told to immediately bring back children studying abroad. This may be a sign of further international relations uncertainty to come. Russia may be signaling an increased presence in conflict regions such as Turkey and Syria which will ultimately lead to Global tensions, and as the new US president he/she will have to immediately defuse the situation. This will concentrate their focus abroad instead of domestically allowing the economic initiatives to be put on the back burner.

Next we have the US election, both candidates are viewed unfavorably by investors. While the market seems to view Presidential nominee Hilary Clinton in a favorable light, many argue her stance on bank regulations and tax reforms will continue to force businesses and wealth out of the US. This capital outflow will seek safe havens in other countries, driving down the US dollar compared to baskets of other currencies.

US debt is the highest it has ever been and will continue to increase at mind-boggling rates. The Federal Reserve may need to consider the effect of quickly raising rates on US debt payments. Those payments will quickly increase in size further burdening an already stretched budget deficit in the US.

Small businesses in the US are reporting difficulty getting started, with the most regulations in our country’s history many businesses are spending months each year focused on simply complying with regulations and paperwork instead of making products or innovating. This will affect our productivity levels and keep them relatively low, which has been consistent with the past few years of economic data.

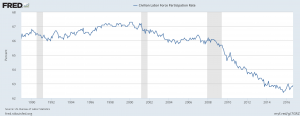

With the slowdown in startup small businesses, the heavy burden of regulations, and large businesses moving their operations to international headquarters we have seen a large portion of our population in the US opt to stop looking for jobs, otherwise shown in the diagram above labeled Civilian Labor Force Participation Rate. This portion of the US population may struggle to contribute to the economy in terms of simply being consumers. Consumers make up 70% of our Gross Domestic Product, and if a large portion of them are not in the labor force then they are not earning a wage. If they continue to not participate in our labor force we will continue to see slow economic growth as we have in the past years. Thus we will be in a cycle of large government spending, low rates and slow economic growth.

If we break the cycle we are currently in we may see two very drastic outcomes. We will have to face the fact that we may no longer be able support our country if we can’t issue large amounts of debt. In this scenario we will only create wealth for those in the stock market as working jobs will continue to be harder to find. The alternative solution is we encourage businesses to move their operations to the US and promote startup businesses both small and large. They will create a large demand for labor in the economy. As the labor supply adjusts to meet this demand we will see a period of rapid economic growth as our labor force participation rate increases. This will drive our economic growth rate to increase as more capital flows throughout the country, thus driving further investments in the US.

Until this point we have been stuck in this cycle which has been a period of relative calm and slow economic growth, this growth has been financed by low interest rates and creative financial engineering. Ultimately the deciding factor in this analysis is who is elected President of the United States of America and the policies they enact. We note how our economy, politics and international affairs are becoming ever more interconnected and one of the most connected pieces is changing, the US President. This change will have many affects on our stock markets, regulations in businesses, international affairs, trade relations, etc. The focus of the President will determine what we may expect for the next four years and will add certainty into our Countries future. If they choose to focus on the economy and decrease regulations and promote small businesses or they focus there efforts elsewhere then we may see a large increase in new businesses and employment whereas if they continue to increase regulations on big businesses that will also affect the smaller businesses in turn driving a large portion of the tax base out of the country and keep the labor participation rate low. This compounded with our debt problem will send the country into a recession, also nicknamed by the financial markets as “The Ninth Inning” of the bull market.

Article Referenced:

https://fred.stlouisfed.org/series/CIVPART