Using Information Cascades to reflect on Tulip Mania

In the present and future, technology and globalization have the ability to impart powerful social forces to influence behaviors in all facets of our economies and organizations. These influences may be based on sound and logical reasoning, but can also be based on “herd instinct” or emotional responses to stressful events.

The way this phenomenon occurs is explained by the term “information cascade”. An information cascade happens when an individual changes their behavior based on inferences they make by observing other people’s behaviors, ignoring their own personal information. The idea reflects on how people do something against their own due diligence due to strong social pressure to follow the crowd. The term came about by Banerjee, Bikhchandani, Hirshleifer, and Welch in the early 1990s, but the behavior can be traced back to many instances in history.

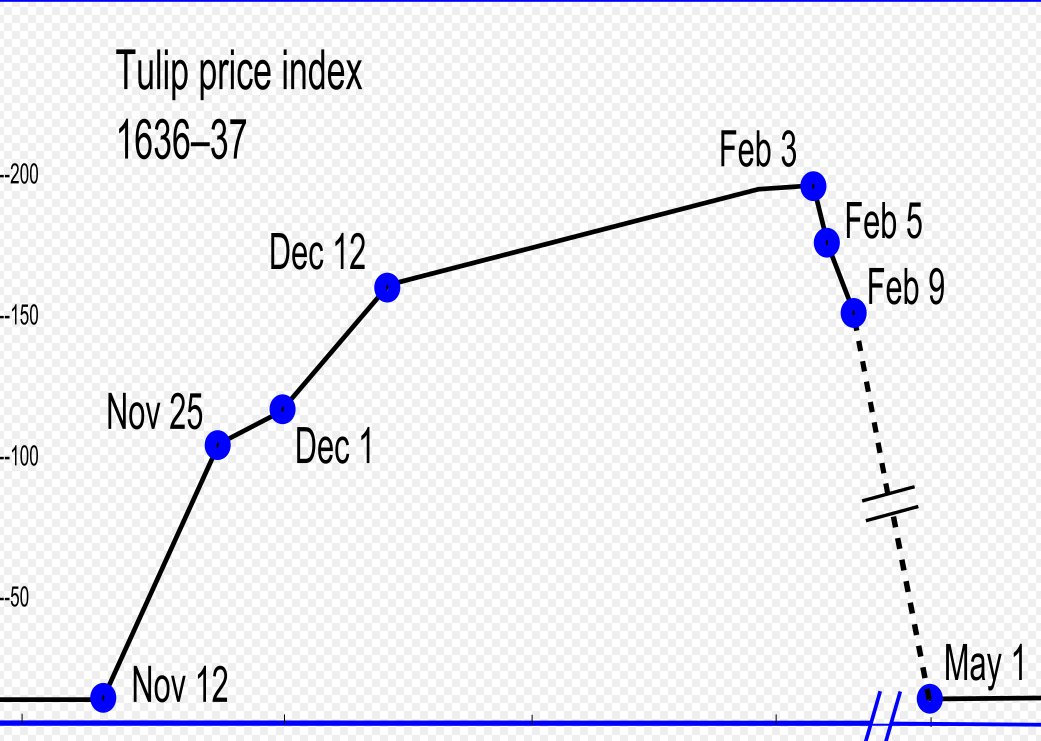

One particular notable example of this came about during the 17th century in the Dutch Republic regarding the price of tulips. “Tulip Mania” was a period when tulips in Holland reached extraordinary levels in value and crashed significantly in the late 1630s. Tulips, commonly valued at the price of an onion at the time, went up to astronomically high values as they were seen as status symbols for royalty. People put their estates and life savings into the purchases due to a strong social pressure to buy it to capitalize on the inflationary values of the bulbs and its limited supply. The tulip market saw high speculation, with twenty-fold increases in value in one month. The collapse began in February of 1637, when people in Haarlem failed to show up to an auction (most likely due to the plague going on during the time). Panicked sell offs and the lack of liquidity in the market resulted in a steep price decline in May, eventually bursting the bubble and the market.

Dutch tulip price index

While the tulip mania primarily reflected this herd behavior and making decisions on faulty public information, there are specific reasons that help further prove this example was an information cascade. As prices began to rise, new and less knowledgeable traders entered the market, which transformed from a small group of tulip growers to an abstract and speculative market. For instance, a futures market developed, as people began to sell bulbs for which they had signed a contract but which they did not yet have in their possession, meaning that traders could make profits without ever needing a tulip bulb.

Moreover, no guild control created low barriers to entry and the high capital in Holland at the time advanced the risk for which people engaged in these risky contracts. Many of those in the tulip trade in a given town were closely connected through several different networks. Many were related by blood, marriage, region, and culture. These close ties further facilitated the rapid dissemination of information among traders, but also gave inaccurate and inflated sense of expertise of their peers, further increasing the illogical public information in this information cascade. No real knowledge of the tulip variety and their bulbs was required, only the going rate for a tulip variety, increasing the speculation in the market.

This particular information cascade can be seen repeatedly in our financial markets, from the overpricing of tech stocks in the 1990s to the inaccurate Moody ratings with the 2007 subprime mortgage crisis. The fact that irrational investing, whether based in investments into sketchy ICOs with cryptocurrency or investments based on advice of megafunds and activist investors, still remains even four centuries later, showcasing a core failure in the human psyche to predict accurately, revealing the need for individuals to do their own accurate due diligence before learning from the crowd.

- http://www.maurits.net/Research/TulipMania.pdf

- http://sites.uci.edu/dhirshle/files/2011/02/Herd-Behaviour-and-Cascading-in-Capital-Markets-a-Review-and-Synthesis.pdf

- https://eml.berkeley.edu//~kariv/CK_II.pdf

- https://www.economist.com/blogs/democracyinamerica/2011/10/mass-movements