Analyzing the “Kimchi Premium” in the Lens of Tipping Point

https://medium.com/santiment/kimchi-premium-the-hidden-history-of-cryptocurrency-in-korea-91b7022a7c65

Bitcoin is a cryptocurrency that was first introduced in 2009 by Satoshi Nakamoto. It is a digital currency that can be transacted without the control of central banks. The coins are generated when a block of chains is mined, and the price of a Bitcoin fluctuates depending on the supply and demand of the currency. Though the information about and the usage of Bitcoin constantly rose over the years, one country showed a significant increase in the exchange of Bitcoin in 2017 – South Korea.

In 2011, the price of a Bitcoin started at $0.3. By January 2014, it increased to as high as $770, and at the start of 2017, the price was $998. On January 1st 2018, the price was $13,412.44 after hitting the all-time high of $19,666 in December 2017. The exchange of Bitcoin in South Korean market was so dominant, however, that the local price of a Bitcoin was higher than in the Western market by 50% at one point. The difference in price of a Bitcoin between the Korean market and the western market is what is called “Kimchi Premium”

The diagram above illustrates Kimchi Premium between October 28th, 2017 and January 26th, 2018. The red line indicates the price of a bitcoin in a Korean market versus the blue line which indicates the non-Korean markets. It is interesting to note, though, that just at the start of 2017 the price of a Bitcoin in a Korean market was equivalent to other markets. How can this phenomenon of Bitcoin fever be explained?

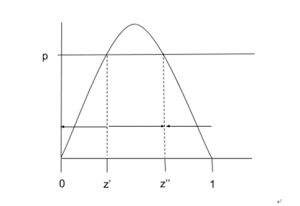

The theory of tipping point perfectly suits such a phenomenon. Introduced by Malcolm Gladwell in 2000, this theory contends that when a proportion of users using a product with a positive network effect pass the “tipping point”, the majority of the population will adopt the product. The diagram below substantiates the theory.

Z is the fraction of the population using a product. Z’ is the tipping point, and when the z passes z’, it increases to z’’. Nonetheless, if the value goes below z’, it will virtually fall down to 0.

In the case of Kimchi Premium, the product was Bitcoin exchange, and when the fraction of the population exchanging Bitcoin passed the z’ value, the fraction hit the z’’ value where majority of the population exchanged Bitcoin, creating the Bitcoin fever and eventually Kimchi Premium. Though more analysis is needed to determine the exact z’ and z’’ value, the social phenomenon in South Korea clearly follows the theory

In 2018, however, the usage of Bitcoin dramatically dropped in South Korea, erasing the Kimchi Premium. The cause of such a decrease in usage was due to regulation imposed by the South Korean government after the government saw the cryptocurrency usage as an overheat. The price of Bitcoin quickly came tumbling down, and so did the fraction of population involved in Bitcoin exchange in the South Korea. Once accounting for 20% of Bitcoin exchanges around the world and being number one country to participate in Bitcoin exchange, the Bitcoin fever quickly died down and the Kimchi Premium doesn’t exist anymore. It can be inferred that the fraction of population exchanging Bitcoin fell below the z’ value and hit near 0.

Of course, there are other factors that affected the usage and price of Bitcoin. Nonetheless, the creation and disappearance of Kimchi Premium based on the popularity of exchange of Bitcoin clearly exemplifies the tipping point theory in real life. It will be interesting to observe whether the fraction of users will ever pass the z’ value again so that majority of the population will exchange Bitcoin again.