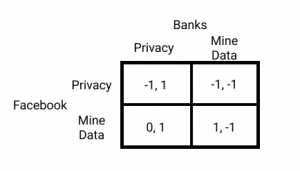

Facebook vs. Banks: Matching and the Payoff Matrix

Link to the news article: https://www.wsj.com/articles/facebook-sought-access-to-financial-firms-customer-data-1537263000?mod=hp_lead_pos6

In the article “Facebook and Financial Firms Tussled for Years Over Access to User Data”, the authors AnnaMaria Andriotis and Emily Glazer describe how concerns over user privacy has caused financial firms to resist granting Facebook access to users’ sensitive financial information. This article illustrates how Facebook uses personal data to “match” users with products they might want to buy. It also shows how changing attitudes towards online privacy has affects Facebook’s and the banks’ payoff matrix.

It is widely known that Facebook utilizes a user’s personal data (their likes and dislikes, their hobbies, their interests) to show relevant ads. In a sense, Facebook is “matching” the user with items that they might want to buy. The more effective these matches are (i.e. the more people that buy the items Facebook shows them), the more valuable ad-space on Facebook becomes and the more money Facebook can generate through mining user data. If Facebook were able to access users’ financial information, they would be able to see the kinds of things that users’ buy and how much they usually spend on items. Knowing what users have bought and their approximate budget will greatly improve Facebook’s matching and could increase the platform’s value to advertisers.

However, the recent concerns over data privacy and Facebook’s Cambria Analytics scandal have influenced the strategies of both Facebook and financial firms. For Facebook, creating targeted ads from user data is how Facebook makes money, and to cease doing so would cause the company to lose a lot of revenue. Although data mining could lead to fewer Facebook users and future government regulation, Facebook would be able to keep its main revenue source. On the other hand, the costs of mining data (losing customers due over privacy issues) greatly outweigh any money the bank could have gained through increased shopping from targeted ads. Thus, it’s clear that Facebook’s dominant strategy is to always mine data while the banks’ strategy is to always try to protect the privacy of their customers, thus the conflict between the two groups. The graphic below illustrates the payoff matrix; the higher the number, the greater the benefit that that strategy brings.