Information Cascades and the Recent Recession

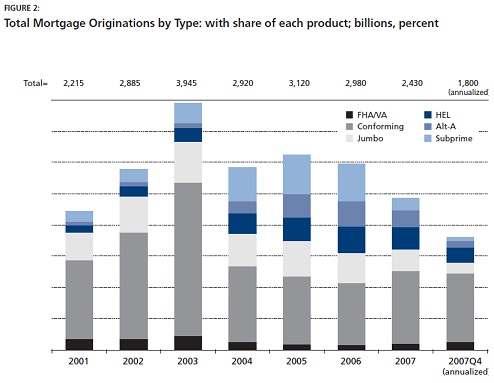

In this paper, entitled The Origins of the Financial Crisis, Martin Neil Baily, Robert E. Litan, and Matthew S. Johnson argue that the recent recession can be largely attributed to the rapid rise of lending to subprime borrowers, which came with expectations that housing prices would rise as they had been from the mid 1990s to 2006. As seen in the diagram below, the total number of mortgages that were subprime increased from 2001 to 2006 before finally falling in 2007, when panic hit and everything shut down.

The phenomenon of information cascades can be seen through this real-life example. First of all, more and more people maintained the positive view that the housing price bubble would continue rise, partially because everyone else already thought so. The rapid increase in subprime mortgages and eligibility of previously unqualified households for mortgage loans contributed to this rising housing price bubble. An information cascade occurred as soon as lenders began making these loans to unqualified households. An individual lender, seeing many other investors around him distributing subprime mortgages, may decide to do the same against his own better judgment. Since everyone else was making risky loans, it seemed like the right thing to do. Such herding behavior caused increasing numbers of lenders to join in on the action and pursue the large profits that subprime-mortgages seemed to promise, rationally deciding that there was others had good reasons to do so. Due to this information cascade, lenders were more inclined to believe that everyone else must have better information, making risky lending more attractive and more acceptable.

This example well illustrates the “Lessons from Cascades” in Chapter 16.7 of Networks, Crowds, and Markets: Reasoning about a Highly Connected World by David Easley and Jon Kleinberg. Evidently, this cascade was wrong. Subprime mortgages and risky lending led to the inflated housing price bubble, which was backed by credit that did not actually exist. This cascade was also based on very little information. Lenders (and home-buyers) discarded their own judgments and chose instead to mimic the “rational” actions of others. Of course the cause of the financial crisis was far more complicated than this simple explanation, but the theory of information cascades well-describes the general and underlying force that drove the U.S. economy into recession.