Name Your Own Price

Up to now, all the market models we have encountered are all seller-oriented. However, buyers can also lead the transactions. Name-Your-Own-Price (NYOP) system is such a system under which buyers make a suggestion for a product’s price and then a seller decide to accept or reject this quoted price. As the Internet is continuously being developed and the online marketplaces are becoming increasingly more popular, consumers have more choices in terms of product pricing. Popularized by the reverse auction pioneer, Priceline.com, such pricing strategy asks consumers to ‘name their own price’ for various products and services like air tickets, hotels, rental cars, … etc.

This year, researchers from John Molson School of Business, Concordia University, Canada examine the impact of NYOP-opaque selling from an operations perspective. They establish a stylized model and also conduct an experimental survey to validate some market-end assumptions.

What does “NYOP-opaque” mean? Let us consider how NYOP works. Suppose you are looking for a round-trip air ticket from JFK to LAX departing on Dec 7 and returning on Jan 3. At Priceline.com, you provide all the information of your fights as well as the price you are willing to pay. Then Priceline will assign your flights if your quoted price is accepted. However, until you receive your flight ticket number, you do not learn the specifics of the trip, like airlines, number of connections, departure or arrive time and so on. That is the point to be “opaque goods” features of which are unknown to the buyers at the time of purchase. Moreover, using NYOP means commitment to buy. That is, once the transaction occurs, your flights will be charged immediately.

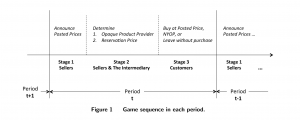

In the case of buying opaque goods, NYOP seems to be less inviting. However, through NYOP you have a chance to save your money. The model the writers propose incorporates three sets of stakeholders: two competing sellers, an intermediary NYOP firm, and a sequence of customers. The sellers both have direct channels, like their own website, to directly sell their products via posting prices. They can also choose to have another NYOP channels to give their consumers a chance to make a bargain. Each seller holds some initial inventory, which will expire after some time periods and can not be replenished. In each period, the same three-stage decision making takes place, as depicted in Figure 1 below. Notice that the if a intermediary firm successfully pairs a buyer and seller, it will earns the difference between buyer’s bid and seller’s reservation price and it is a revenue maximizer.

After some computation and discussion on different conditions, the writers conclude that the implications can be very different for competing sellers under dual- versus single-channel structures. In particular, more inventory may reduce one’s expected profit, which never happens when a seller uses direct channel only. Interestingly, although competing sellers do not always benefit from the existence of NYOP channel, but it is possible that one or both of the sellers will still adopt it in equilibrium.

The experiment also verifies the model. The participants are asked to book a hotel between Hotel A and Hotel B and have three options: book Hotel A and pay a certain price, book Hotel B and pay a certain price or submit a bid of one of a set of provided values. To check the model, each participant is given three scenarios of no information about auction winning probability at all, only know the probability for each hotel to appear if bid is accepted and know the probability of accepting the minimum price as well. The results confirm the impact of valuation on bidding as predicted by the model, that is the lower valuation, the higher bidding . The impact of prior on bidding is also confirmed. The higher probability for better hotel to appear means the higher bidding.

Although this is a first study on complex NYOP model, it is still far from what happens in real life. Opaque product design, contracting, information availability and social media impact are expected in future research.