Network Analysis of the ownership of Global Corporations

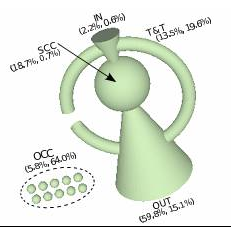

A recent study by Vitali, Glattfelder, and Battiston entitled “The network of global corporate control” revealed several remarkable aspects of the ownership interactions between a sample set of the 600,508 most powerful trans-national corporations (TNCs). This type of analysis has been previously attempted and failed to gather any significant results, however all previous attempts have been at the national level and not the global level. The researchers created a network map where each corporation was a node, and there was a directional edge between nodes in which one corporation directly or indirectly owned shared in another corporation. In total, this resulted in a map of 600,508 nodes and 1,006,987 ownership ties connecting them. The network maps out to be a bow tie shape, the same shape as the World Wide Web, with the top actors, determined by ownership influence, occupies the central core. The map consisted of many sub networks, the largest of which (3/4 of all nodes) virtually was a list of the top TNCs by economic value. This group accounted for 94.2% of the operating value of the entire map. On the contrary to the previous attempts, this analysis revealed a central group of 737 TNCs which the authors denote the “Strongly Connected Component” (SCC) which has a controlling interest in 80% of the network. A strongly connected component was defined as a set of firms in which every member directly or indirectly owns shares in every other member of the strongly connected component. Additionally, within the SCC is a group of 147 TNCs called the super-entity with a controlling interest in 40% of the other TNCs mapped. A TNC within this core has a 50% chance of being among the top 50 holders in the entire network, compared to a 6% chance for a TNC in the network’s IN section (see figure).

The existence of these two small components of the network, a previously unknown fact, can have several implications to the way economists, policy makers, and businessmen approach the global corporate economy. The authors of the paper prompted two of its many implications; implications for market competition and those for global economic stability. They deduced that as seen by the numerous anti-trust cases in the United States and in other national economies, the existence of such a group would serve to weaken market competition simply on the principle that “concentrated ownership stifles free market competition”. They did not reach any concrete conclusions regarding possible implications for economic stability, however as seen by the 2008 financial crisis in the United States, firms with many close ties to one another tend to enter a state of distress and panic at approximately the same time due to their numerous overlaps in various aspects of their companies.

This study exemplifies the ways that network analysis, along with a set of relevant data, can reveal aspects of the interactions between any set of participants that can go unrealized without network analysis. The interdisciplinary attitude of the science of network analysis serves to make it compatible with most any genre of network, furthering the suggestion that it’s immergence as a powerful scientific analysis tool has just begun.

http://c1.planetsave.com/files/2011/08/TNC3.jpg

http://arxiv.org/abs/1107.5728