Game Theory as a Model for The Organization of the Petroleum Exporting Countries (OPEC)

As I delved deeper into the objectives and provisions of the Organization of the Petroleum Exporting Countries (OPEC), I couldn’t help but notice the striking parallels between its goals and the principles of Nash equilibrium in game theory. Founded with the aim of coordinating and harmonizing petroleum policies among its member states, OPEC has been successful in ensuring fair and stable prices for oil producers, an expedient, affordable, and steady supply of oil to consumer countries, and an equitable return on investment for those who invest in the sector.

However, in recent years, some of the organization’s major oil-producing members have threatened to withdraw from the accord, citing that it is slowing them down. Despite these challenges, OPEC has managed to maintain compliance among its members, with an average compliance rate of around 80% in the last decade.

One key aspect of the OPEC agreement is the agreement among its members to have the same prices range for oil and to cap the number of barrels produced per day. This creates a globally optimum solution for its members, where staying in the agreement is the best choice for all members, regardless of what other members do. If a member leaves the agreement, they will lose a significant portion of OPEC customers, forcing them to drop their pricing in an effort to attract additional customers. This ultimately caps their profits at a lower level than if they had stayed in the agreement.

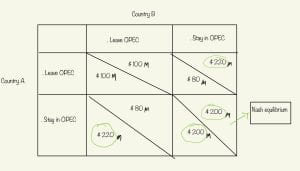

To further illustrate this point, I ran a simulation of alternatives available to members debating whether to withdraw from the agreement. In the simulation, when both country A and B leave the agreement, they both lose a sizable portion of OPEC customers, forcing them to drop their pricing to attract additional customers. However, the market split and associated dynamics will cap their profits at $100 million each. But this is not a balanced outcome, as whichever of the two countries decides to stay while the other leaves will earn a respectable profit of $220 million, which is obviously preferable to the $100 million. Therefore, the optimal way to go is for one to stay in the pact.

Although this simulation is not specific to any one nation, it sheds light on why nations like the United Arab Emirates consistently make concessions to remain in OPEC, despite threatening to leave the organization. Staying in the agreement is the globally optimal course of action, or more precisely, the Nash equilibrium in the oil market dilemma. This simulation, along with the compliance rates and statistics, further confirms that staying in the OPEC agreement is the best decision for the member countries.

https://www.opec.org/opec_web/en/about_us/24.htm

Class of 2026