A Look Back At Why Blockbuster Really Failed And Why It Didn’t Have To

You probably know that Blockbuster went bankrupt back in 2010, but what you probably don’t know is that Blockbuster CEO John Antioco was once approached by the founder of Netflix with a partnership proposal, which could have prevented the downfall of Blockbuster had Antioco accepted it. When Antioco met with the founder of Netflix, Reed Hastings, in 2000, Blockbuster was at the peak of its success. It had thousands of retail locations, millions of customers, and abundant marketing budgets. Blockbuster basically dominated the video rental industry at the time. The extreme success of Blockbuster blinded Antioco and made him fail to see what the network effect can bring to a small startup.

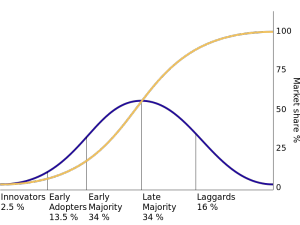

One big weakness of the Blockbuster at the time was that it earned most of its revenue from charging its customers late fees. This may not be a big deal when the public doesn’t have other options to rent videos from. However, when competitors like Netflix emerged, which got rid of late fees by offering subscriptions to its customers, the existence of late fees became essentially the deciding factor when choosing the video-renting service. When Netflix first started off, it was a small niche service that didn’t seem to have the capability to compete with Blockbuster. However, Netflix cleverly chose the online platform to save money from having retail locations. Their business model was able to offer greater variety of videos with a lower cost and no late fees. These features successfully attracted some initial adopters in the population. Once these early adopters experienced the advantages of choosing Netflix over Blockbuster, they told their friends to try it. As more of their friends raved about Netflix, even the people that were reluctant to try at first were convinced to give it a shot. Network scientists call this the threshold model of collective behavior, and the best way to understand thresholds is to look at the diffusion of ideas model as illustrated below in the diagram. The blue line shows the groups of consumers that would successively adopt a product, and the yellow line shows the market share that eventually saturates.

This concept is similar to what we talked in class about the network effect. For any new product, there will be people with varying levels of resistance (depending on their intrinsic value of the product and the amount of population that uses it) to try it. As those who are more willing (early adopters & early majority) begin to adopt the new product, the more resistant ones (late majority & laggards) become more likely to join in. Under the right conditions, a complete cascade can occur. It’s not always clear where the thresholds exist, so it’s not always easy to tell if an idea will spread among the population or just grow within a niche. One thing we do know is that offering better-quality services can always help result in a success. Netflix offered what the customers wanted by eliminating late fees and providing good service with lower costs. It made the right calls and became a company that’s worth billions of dollars now. Unfortunately, Blockbuster’s CEO John Antioco underestimated the potential of Netflix and failed to make changes in its company, which lead to the ultimate downfall of Blockbuster.

Source: