Game Theory and Network Effects in Open Source Software

http://www.anshublog.com/2006/07/lets-play-games-open-source-generates.html

http://mayet.som.yale.edu/coopetition/

Anshu Sharma explains how Open Source Software, the kind of Software that’s freely available in Source Code form, generates lots of value but little revenue. He references the book Co-opetition by Harvard Business Professor Adam Brandenburger and Yale Management Professor Barry Nalebuff, which is about how to balance Cooperation and Competition in Business to gain the benefits of both. Open Source Software originates from the work of volunteers who want to share their work with others for the benefit of the community as a whole. Vendors like Red Hat and Novell build pre-configured Open Source solutions for businesses. Because of low barriers of entry in the Open Source Vendor game, prices are kept low. Ashnu notes that “And this is exactly what game theory predicts- in a market with low barriers to entry it is hard to charge premium prices and make profits over an extended period of time.” Companies like Google, Yahoo, and Facebook have been leveraging Open Source solutions to their own benefit. Even those who don’t benefit from Open Source directly benefit from the competitive pressure put on companies like Microsoft. Ashnu mentions that “the value added by open-source to the customers is not equal to the value added by open-source vendors” and that the low barriers of entry make it so that the potentially infinite pool of competitors divide the money going into Open Source solutions, so no single behemoth is reaping all the profit. He suggests that “You are much less likely to succeed by entering the game as a vendor. Your gains are much larger if you can leverage the low cost of open-source software to provide new services to the customer- consumer or businesses”.

http://mobile.blogs.wsj.com/cio/2012/09/03/open-source-software-reaches-the-tipping-point/

In this Wall Street Journal Article, Rachael King hails the mainstream adoption of Open Source Software. She begins by pointing out that “Open source software is becoming more prevalent in business IT shops, not because of any sudden religious conversion, but for opportunistic reasons ranging from speedier time to market to ease of innovation.” This reflects the idea from Ashnu Sharma’s article which says that the inherent value of Open Source software transcends its lack of revenue by means of raising the technology baseline where companies can build upon. Next, she says “Open source is reaching a tipping point with broader adoption of open source in the enterprise, beyond tech savvy companies such as Facebook or Google that have deep expertise in its development”. This means it’s not just the big players in software who are benefiting from Open Source Software directly, but also the startups, small businesses, other even larger companies less focused on software. Take for example MasterCard, which “makes use of open source software to create working prototypes of mobile apps it hopes will help it stave off competition in the global payments market from possible disruptors such as PayPal or Square.” This shows how larger companies like MasterCard manage competition in mobile, a relatively new area for Finance, with a little help from its friends in Open Source.

We can see how the idea of Cooperation versus Competition with respect to Open Source relates to class by considering the following game, where two companies have the choice to either cooperate and open source their software, or to defect and close source their software:

| Open Source | Closed Source | |

| Open Source | (1,1) | (-2,2) |

| Closed Source | (2,-2) | (-1,-1) |

The only Nash Equilibrium is (Closed,Closed) where both companies close the source of their software, but clearly there is a better alternative in (Open, Open) when both companies open source their software. Why don’t both companies choose the option that’s better for them both? This is just the prisoner’s dilemma, where neither company can unilaterally improve their situation. Now let’s consider the modified game where each company helps each other out by feeling the payoff or deficit of the other. Specifically, let the new payoff for each company equal its original payoff plus half the payoff of the other company. Here is the resulting game:

| Open Source | Closed Source | |

| Open Source | (1.5, 1.5) | (-1,1) |

| Closed Source | (1,-1) | (-1.5, -1.5) |

We find that there are two Nash Equilibria this time, and fortunately, one of them is in the (Open,Open) scenario where both gain their maximum payoff. This shows that a delicate balance of incentives go into the decision for companies to Open Source or close source their software. The shift from game 1 to game 2 reflects what Rachael King says about the opportunistic reasons for open source adoption. Once people are less worried about direct revenue, but begin to value the sum benefit of society, more open source software gets produced, which in turn gives people the chance to build even more open source software on top of it. It’s a perpetual feedback loop that can only keep growing.

But why doesn’t everything become open sourced? Some would argue that closed source software makes independent companies compete more, and this would make a better end product. In the routing game, we learned that sometimes making another path can decrease the payoff for everyone involved. Like the routing problem, if there is an open path between every company, it may lead to an un-optimal equilibrium compared to one which has less open paths. Likewise, when anybody can enter the market place, the payoff for each player is less than if there were fewer players.

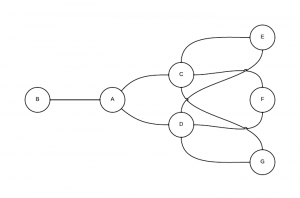

Next we’ll discuss power in the context of Open Source software. As mentioned, companies like Google, Yahoo, and Facebook have been leveraging Open Source solutions to their own benefit and even those who don’t benefit from Open Source directly benefit from the competitive pressure put on companies like Microsoft. Let us formulate this in terms of Network Exchange. Following graph shows how Company A has more power than consumer B and companies C and D because it can negotiate with any of them, whereas they can only negotiate with it:

This next graph shows what would happen when C and D have the option to use open source technologies:

It increases C and D’s relative power, and decreases the relative power of A, thus increasing the relative power of consumer B. Practically, this would mean A offers lower prices in order to compete with C and D, whose costs are lower because they have been building on top of open source software. Thus, the increased competition that results from Open Source software is better for consumers.