The USDA recently announced an extended deadline to enroll in 2023 Dairy Margin Coverage (DMC). Dairy farms now have until January 31, 2023 to complete their enrollment. If you are still on the fence, you have a few extra weeks to make a decision. Here are a some questions to ponder if you are undecided.

What is the “margin” in Dairy Margin Coverage?

DMC allows dairy farms to protect a “margin” defined as the difference between the national price of milk and the average cost of feed. FSA calculates this margin on a monthly basis using average prices for corn, alfalfa, and soy. You can view historic monthly milk prices and feed cost data alongside actual DMC margins from 2019 through October 2022 on the FSA program website.

What triggers a payment?

Farms enrolled in DMC receive payments when the margin falls below a farm’s chosen coverage level. Farms can select a coverage level ranging from $4.00 to $9.50 in 50 cent increments. The higher the coverage level, the higher the odds of a payment being triggered in any given month. Because the margin is calculated using national averages, farms enrolled in the program do not have to submit claims in order to receive payments.

How much are the payments?

When a payment is triggered, the dollar amount per hundredweight will equal the difference between the coverage level and the actual DMC margin. Let’s assume a hypothetical dairy selected the $9.50 coverage level for 2022. In August of 2022, the actual margin was $8.08. Therefore, the payment for that farm in that month would have been $9.50 – $8.08 = $1.42 per hundredweight.

The DMC program allocates pounds of covered production history evenly across 12 months. If our hypothetical farm has 5 million pounds of covered production history for the year, the covered production history in each month would equal 5 million divided by 12, or 416,667 pounds. If we multiply $1.42 per hundredweight by 416,667 pounds, then divide by 100 pounds per hundredweight, the farm’s total DMC payment for August 2022 would have been $5,917.

How much does Dairy Margin Coverage cost?

The cost to the farm depends on the volume of milk enrolled in the program and the level of insurance that the farm chooses. A farm may choose to enroll a percentage of their production history, ranging from 5% to 95%, in 5% increments. The first 5 million pounds are covered under Tier 1 pricing.

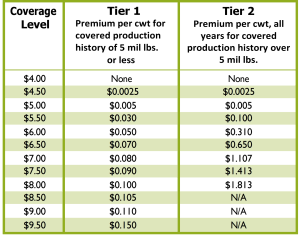

The DMC program offers free catastrophic coverage for Tier 1 milk at the $4.00 coverage level, although there is an administrative fee to enroll. Tier 1 premiums increase as the coverage level rises, reaching $0.15 per hundredweight at the $9.50 coverage level. Premiums for other coverage levels and for Tier II production are listed in the table below. If the producer selects a coverage level of $8.50 or higher for Tier I, they may enroll additional milk production under Tier II pricing.

Figure 1. Tier 1 and Tier 2 pricing at various DMC coverage levels.

Source: FSA Dairy Margin Coverage Program Factsheet

How has Dairy Margin Coverage performed in the past?

The DMC program began in 2019. Since then, payments were triggered in 7 months in 2019; 5 months in 2020; 11 months in 2021; and 2 out of 10 months so far in 2022.

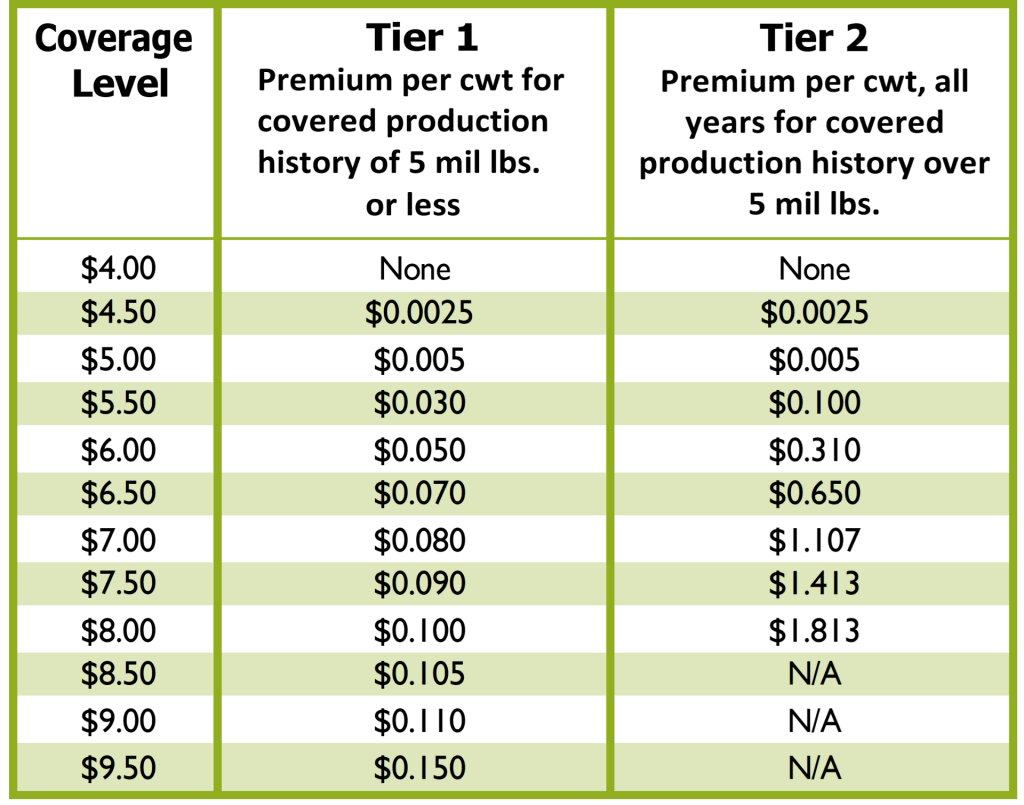

Using the DMC Decision Tool, we can look at estimates of how DMC would have performed in years before 2019. According to these estimates, a dairy with 4,750,000 pounds of covered production history enrolled at the $9.50 coverage level would have had a positive net benefit from DMC in 18 out of the last 20 years, with 2005 and 2014 being the only exceptions (see Figure 2). Even in 2022, despite high milk prices, farms enrolled at the $9.50 coverage level will receive DMC payments in excess of their costs as high feed prices drove margins down to $8.08 in August and $8.62 in September.

As illustrated in the figure below, the downside risk of enrolling in DMC is limited to the cost of enrolling in the program, while the upside risk is more variable and dependent on market conditions. You can run your own simulations using the same DMC Decision Tool at https://dmc.dairymarkets.org.

Figure 2. DMC net benefits from 2001 to 2021 for a dairy with 4,750,000 pounds of covered production history at the $9.50 coverage level.

Source: DMC Decision Tool

Will the benefits of Dairy Margin Coverage exceed the costs in 2023?

It is impossible to predict what the markets will do in the coming year, so no one knows with certainty whether there will be a net benefit in 2023. However, it is a known fact that your income from DMC payments will never exceed the cost of your annual premium if you do not enroll.

Currently, price forecasts suggest that the DMC margin will drop below the $9.50 coverage level for the first 8 months of 2023, triggering payments in excess of premium costs for Tier 1 milk. The actual payments may end up being lower, or higher, than the current projection.

For a relatively small fee, DMC allows dairies to establish a floor that protects their margin. How much is that security worth to you?

![]()

This is material is based upon work supported by USDA/NIFA under Award Number 2021‐70027‐34693.