Should you sign up for Dairy Margin Coverage in 2020? Cornell Professor of Agricultural Economics Andrew Novakovic shares his thoughts on DMC in 2020, and the factors that a dairy operation should consider when making that decision.

As you perhaps are already aware, we have barely closed the 2019 inaugural sign-up for the Dairy Margin Coverage and the 2020 sign-up period has opened. Producers have until 13 December to make their decision for next year. I would not anticipate an extension of this closing date.

The design and parameters of the 2020 program are identical to 2019, including Production History for those producers who have established one. What is different are two very important things.

First, unlike 2019, farmers will have to make a decision without knowing that they have absolute certainty to have benefits greater than their enrollment costs. That extremely unusual but fortuitous situation, of course, only existed because Congress generiously made the new (ish) program retroactive over a period of time when the national margin (ADPM) was below the new $9.50 trigger for the first 5 million pounds enrolled. It was a sure bet.

Secondly, 2019 was a year that started in the doldrums but moved up, which was predicted by most every analyst. In sharp contrast, 2020 will begin with the benefit of the uplift in prices and higher margins from this Fall and most analysts are bullish for dairy returns in 2020.

Needless to say, forecasting market events is a business that, like dairy farming, offers no guarantees. Continued meddling in the flow of dairy product trade, increasing consumer concerns about the healthfulness or environmental affects of dairy product consumption, a much shorter corn harvest than is currently expected, a recession that takes the breath out of restaurant sales, and/or who knows what could conceivably sour dairy margins relative to current expectations. For what it’s worth, I am among those who believes prices and returns will be marginally greater in 2020. I do expect prices and returns to hit a cyclical peak in 2020 and begin softening again in 2021 but my gut instinct is that restrained national production and a better harvest next Fall will make any such downturn modest. We might find that it is more of a flattening than a genuine downturn. Having said that, I am acutely aware that my opinion falls far short of a check you can take to the bank. Every producer will have to weigh their own risk tolerance and consider all the tools available for risk management, including Dairy RP and the various cash management and other strategies they can employ in how they manage their operations.

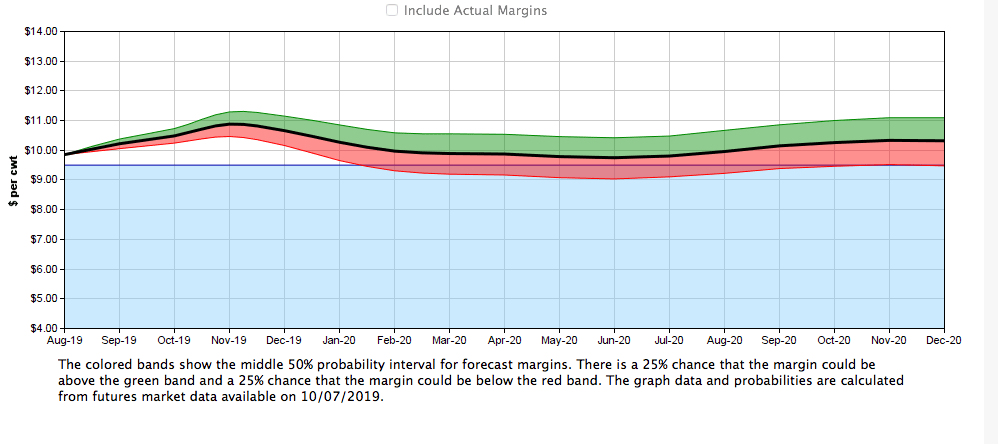

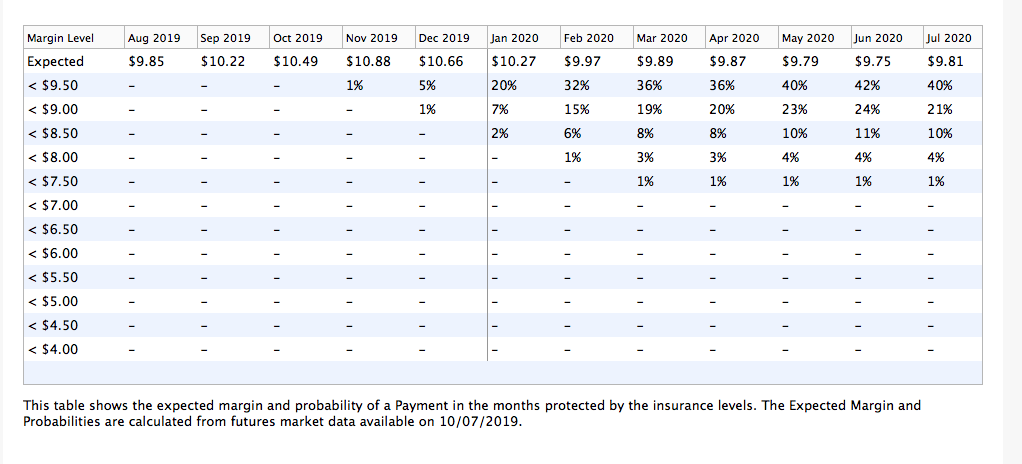

I would encourage you and the producers with whom you interact to take advantage of the DMC planning tool on our DairyMarkets.org website. Today’s pictures look like this:

The graph, based on information about milk, corn, and soybean futures and options prices on the CME, suggests that there is some possibility of a national margin that would trigger a payment at $9.50 in the first few months of 2020, but the actual probabilities shown in the table would suggest that these are far from a sure bet.

As is generally true in an up year, price or revenue risk protection is likely to be more effectively achieved through 1) various forward pricing mechanisms, including individual futures or options contracts or forward contracting with ones cooperative or 2) Dairy RP. In essence, these types of programs allow farmers to “lock in” returns based on prices anticipated in futures markets as opposed to the fixed margins specified by DMC. One can’t “lock in” a $10 margin or an $18 milk price with DMC, but those are potential options with other risk management tools. Again in the “for what its worth category”, I would caution against the attitude of worrying about “leaving money on the table” by locking in a decent price in an up market that might go higher. That is always a possible scenario, but I don’t think this is a moment for giddy expecations about high prices for milk. Locking in a price (or prices if one includes inputs) that results in positive returns could be an especially wise strategy given current market uncertainties. Jenny Ifft and Chris Wolf are good Cornell resources for additional information about these kinds of programs and possible producer strategies.

Lastly, I would urge you to consider talking about cash management strategies during this period of more positive returns. The range of farm situations is, like always, wide, but many farmers have open accounts and deferred repairs, maintenance and investment. These are all items that need tending. Having said that, my gut instinct, no doubt influenced by my family’s frugality, is that to the maximum extent possible, this is a good time to try to build a better cash reserve or working capital as a protection or cushion against the next downturn.

– Andy