Market Competitiveness and Game Theory

In free and mixed market economies, companies are supposed to compete with each other in order to maintain and increase their control over a particular market. This competitive nature can be seen all over the world in a variety of different markets. One of the simplest examples is of the smartphone industry where market share is rather evenly divided between companies such as Samsung (21.8%), Huawei (18.6%) and Apple (13%), with each tech giant offering a variety of different benefits to their consumer base (statista.com). This competitiveness is generally what tends to drive down the prices for items sold in a particular market as companies know that if a consumer’s valuation of their product does not match its price, they will take their business to their competitors. In other words, a highly competitive market is generally a very good thing for the consumer, but not always for the companies, as Vasant Hegde explains in his perspective article Have you applied Game Theory? published in the Deccan Herald.

In Hegde’s article he delves into the growing market of low-cost air travel in India where airlines such as Indigo, Jet and SpiceJet have all been investigated and punished by the Competition Commission of India for colluding with each other in order to raise ticket pricing. This type of collusion is seen often in oligopolies, which are markets with only a few different competitors, severely limiting competition, and can be easily explained using Game Theory, in particular, Prisoner’s Dilemma.

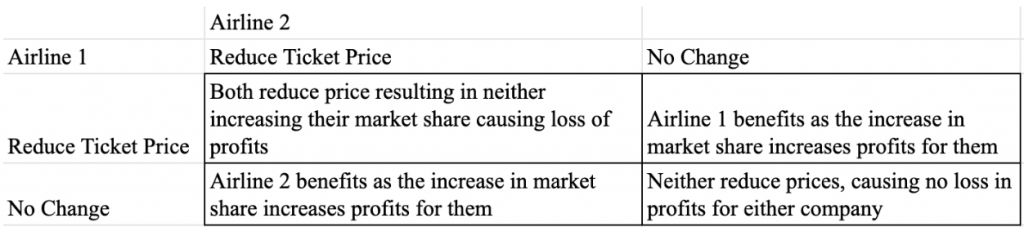

The table above depicts the two major choices these airlines could make, and their respective repercussions given the other’s decision. In the ideal case, neither company would ever have to reduce their prices to prevent a loss in market share and/or profit. Although, in a market where neither company knows what the other will decide, both Airline 1 and Airline 2 choosing No Change isn’t a nash equilibrium. Instead, the nash equilibrium occurs when both of the airlines choose to reduce their ticket prices. This is because if one of the airlines, say Airline 1, chooses to reduce their ticket prices, the best response from Airline 2 is to do the same, and vice-versa. This highlights the major negative impact a free, competitive market has on a company: It cannot dictate the price of an item on its own. This is the main reason Hegde cites in his article for why the low-cost airlines in India colluded to keep their prices steady across the board. They wanted to break the game and ensure that none of them lost their share of the market. Deceptive tactics like this, while beneficial for the companies involved, generally hurt the consumer by increasing the cost they must spend for a product, which is why they are illegal in many countries.

https://www.deccanherald.com/opinion/in-perspective/have-you-applied-game-theory-781103.html