Understanding Cryptocurrency Through Game Theory

Source: https://www.nasdaq.com/articles/a-look-at-the-game-theory-of-bitcoin-2021-09-13

Game theory is using mathematical models to make strategic decisions that will be countered by another player or opponent. While game theory has many applications in fields such as economics and social science, we can also use it to analyze and look at the markets, specifically related to Bitcoin.

This article models the conflict between Bitcoin and governments and banks as a game of chess. Whenever the institutions make a move against cryptocurrencies, Bitcoin has proven to be resilient and recover from any such attempts. Thus, Bitcoin’s dominant strategy in this game against the banks and governments would be to continue to exist no matter if it is being attacked by the institutions or not. On its own, Bitcoin has grown tremendously over the past decade, so it’s clear that when there is no harmful action taken against it, the potential for growth is large. Recently, there have been a number of actions taken against the cryptocurrency, most notably when China banned all Bitcoin miners, yet most of them were able to move to the US or other countries. Other examples include when the United States added a cryptocurrency tax as part of a recent infrastructure bill, but this was met with extreme opposition from Bitcoiners, who called their senators and let them know they were unhappy. Next, the ESG wanted to push the idea that Bitcoin uses large amounts of nonrenewable energy, but the Bitcoin Mining Council reported data that showed more than 50% of Bitcoin usage is through renewable energy. Finally, the IMF strongly urged El Salvador to not accept Bitcoin as legal tender and threatened to not support them, but El Salvador still went ahead with its plans to make it legal tender. So, we see that Bitcoin continues to operate despite setbacks, showing its dominant strategy.

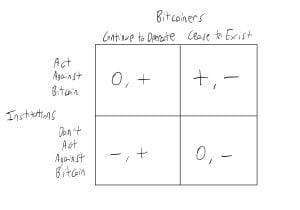

Now, we can directly connect to the course material by building a payoff matrix and finding a Nash equilibrium. The Bitcoiners’ two options are to continue existing and operating, or to completely stop operating, which seems unlikely as Bitcoin could continue to operate underground in the extreme case. The institutions’ two options are to continue making moves against Bitcoin, or to leave it be. So, we have the following payoff matrix:

We see that Bitcoiners have a negative payoff if it ceases to exist, but have a positive payoff if it continues to operate. Institutions have a positive payoff if they act against it and are successful, but a neutral one if they act against it and it continues to operate since nothing changes. Also, institutions have a neutral payoff if they don’t act against it but it ceases to exist since they didn’t have an interest against it, but a negative payoff if they don’t act against it and continues to operate since it still hurts them. Looking at this, we see that institutions acting against Bitcoin, but Bitcoin continuing to operate is the Nash equilibrium, which aligns with the article that Bitcoin will continue to operate despite continuous attacks.