From Niche to Mainstream: The Advent of Alternative Meats

This last year has been an extraordinary one for a once niche industry: alternative meats. The United States’ deep-rooted fast-food joints are now offering kinder, greener alternatives that a broad range of customers, not just vegans, are indulging in. This is not only a testament to the advancements of technology, but also to the intelligent way that food entrepreneurs have cleverly slipped these products into the mainstream of American culture.

These entrepreneurs realized that the diffusion of a product is largely dependent on the consumer’s peers’ decisions – if a node’s neighbors choose to adopt a product, it is likely that the node will adopt it too. In this course, we learned that each node in a network has its own threshold q, which represents a number of the node’s neighbors required for a node to adopt alternative meat.

A decade ago, vegan products such as soy meat were considered exclusionary and niche. The companies making them tended to cater specifically to Americans who maintained a vegan or vegetarian diet. These meats were often sold in health-food stores, which are less visited by common American households. This is because vegans were only 0.75% of the United States’ population (Zampa 2019). In this scenario, the non-vegetarian Americans who did not eat soy meat or visit health-food stores are part of a large cluster. Alternative meat was not attractive to any of these customers because of its niche target audience. As nobody in this modeled cluster adopted alternative meat, there was a low chance that the cluster as a whole would adopt it. Similarly, vegans can be placed in their own much smaller cluster – they are a tight-knit group that shop at specific food stores and eat at vegan restaurants. The diffusion of technologies is therefore blocked by the boundary of densely-connected clusters in the network (one that is vegan, and one that is non-vegetarian). These closed communities of individuals are tight-knit, and therefore resistant to outside influences. This divide between vegans and non-vegetarians a decade ago made it difficult for alternative meats to hit mainstream consumers. Neither cluster (vegan or non-vegetarian) was interested in adopting each other’s meat, which led to coexistence between the two products. Overlapping between these products was rare.

However, these clusters were broken down upon the advent of Almond Milk. Instead of targeting this product to vegan customers who did not want to consume cow milk, companies targeted the health-conscious – a broader range of individuals including subsets of both vegans and non-vegetarians. With this approach, there was a higher chance of reaching consumers’ threshold values – it was more likely that a consumer’s neighbor would purchase almond milk as it was marketed to cater to all Americans, not just vegans. Because of this strategic marketing campaign, the sale of alternative milks boomed 61% in just 5 years, while the sales of classic dairy milk declined (Mintel Press Team 2018).

Research during this boom found that consumers were indeed motivated by health concerns and the sense that non-dairy products are better for the environment. As a result, alternative meats followed a similar marketing strategy to cater to all Americans.

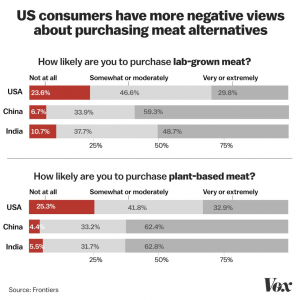

This boom in alternative meat production is definitely a huge positive for the environment. So, does this progress of meat alternatives signal the end of real meat? This question can be answered with the help of the idea of a Threshold model, in which node i will adopt a product if the proportion of their peers is greater than the threshold (Hu 2018). Those targeted through a brand marketing campaign can be divided into 3 main categories: Susceptible, Unsusceptible, and Influential (Hu 2018). Individuals in the susceptible category include those who have a lower threshold for adopting a new product. In this case, this may be because of their increased prioritization of the environment. Individuals in the influential category usually have a higher marketing capacity, and can therefore share their opinions with their followers. Individuals in the unsusceptible category include those who have a high threshold when it comes to buying plant-based meat products. When it comes to adopting plant-based meat, there is still a large proportion of Americans who are not interested in switching to it (Bryant 2019).

The existence of a high percentage of unsusceptible people in this context therefore emphasizes the fact that classic meat may stay in the market for a long time. Despite this, it is exciting to see that alternative meats are no longer a niche product – 40% of nodes in the US network have tried meatless meat, and its positive impact on the environment may continue to increase as a result.

Works Cited

Bryant, Christopher, et al. “A Survey of Consumer Perceptions of Plant-Based and Clean Meat in the USA, India, and China.” Frontiers in Sustainable Food Systems, vol. 3, 2019. Frontiers, doi:10.3389/fsufs.2019.00011.

Hu, Hai-hua, et al. “Strategies for New Product Diffusion: Whom and How to Target?” Journal of Business Research, vol. 83, Feb. 2018, pp. 111–19. ScienceDirect, doi:10.1016/j.jbusres.2017.10.010.

Mintel Press Team. “US Non-Dairy Milk Sales Grow 61% over the Last 5 Years.” Mintel, https://www.mintel.com/press-centre/food-and-drink/us-non-dairy-milk-sales-grow-61-over-the-last-five-years. Accessed 14 Dec. 2020.

Piper, Kelsey. “The Rise of Meatless Meat, Explained.” Vox, 28 May 2019, https://www.vox.com/2019/5/28/18626859/meatless-meat-explained-vegan-impossible-burger.

Zampa, Matthew. “How Many Vegans Are There Really in the U.S.?” Sentient Media, https://sentientmedia.org/how-many-vegans-are-there-in-the-u-s/. Accessed 14 Dec. 2020.