Understanding the Prisoner’s Dilemma in GE Whistleblower Case

https://seekingalpha.com/article/4287957-general-electric-prisoners-dilemma

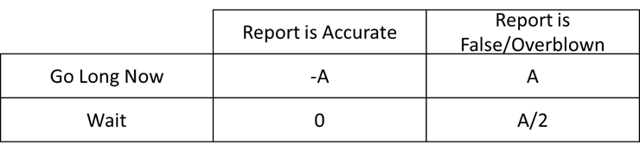

GE is a large-cap company with a market cap of nearly $70 Billion and a solid financial structure. The market estimates the company to continue steady, if not accelerated, growth throughout the course of 2019. As a prominent staple within the homes of millions of Americans, it’s quite unreasonable how undervalued the current price of the shares associated with the company are, which has led many speculators to highly value the stock in the long-term. Recently (Late August, 2019), however, Madoff-associated whistleblower Harry Markopolos published a report that claims GE has committed fraud over a number of years totaling nearly $38 billion. The news has resulted in the diminishment of share price, and the incessant fear is that the report is only the beginning of a deep abyss of scandals, lies, and more heartbreak. As of now, we don’t know how bad the report is. If we pass the opportunity, our profit would be lower if it is overblown, hence the establishment of the prisoner’s dilemma in this situation.

Source: Author’s Charts, Mauro Solies

If we appreciate a long-term perspective, the outcome of the payoff matrix depends on an unpredictable situation. If a short-term perspective is considered, the forecasted profits might be smaller but more determinable and finite. The Nash equilibrium allows us to see that the optimal situation is to wait and see if GE will continue to depreciate unto bankruptcy, or appreciate the value of getting a long position. This ties directly to our studies in class regarding game theory, on a large-scale macroeconomic level. By assessing this topical situation with a component of our understanding (reinforced by Ignacio Palacios-Huerta) of the payoff matrix, it’s useful to assess the valuation of the company in the long-term. Granted, this understanding subtracts the importance of any associated assets and liabilities to GE, however, it helps with the theoretical assessment involved with active management. Investors and consumers alike can gain value from this implementation of the payoff matrix and it’ll be important to keep tabs on in the long-run.