The Social, Economic and Political Effect of Information Cascades

This article from The Economist (http://www.economist.com/blogs/democracyinamerica/2011/10/mass-movements) summarizes the influence of information cascades in social, economic and political behavior using research-based policy analysis from Ellis and Fender’s paper on “Riots, revolutions, democratization, and information cascades”. In the authors’ words, an information cascade is essentially “where people make decisions on the basis of their observations of other peoples’ actions,” as discussed in the course. Ellis and Fender provide the example of various government protests spreading from New York City to Boston to London and continuing on throughout hundreds of cities. According to the authors, “information transmission enabled rioters to coordinate their activities and facilitated the spread of the rioting to other cities”. The researchers supplement this information with a theory that explains why rioting may take place.

The so-called “multiple equilibrium theory of crime” involves a payoff matrix (see Fig. 1) with multiple Nash equilibria and, thus, applies to game theory (discussed earlier in the course) in the following manner. The players are potential criminals who perform a cost-benefit analysis in their decision to commit the crime. The costs depend on the probability of being punished as well as the punishment itself. The probability of being punished depends on the prevalence of resources used to prevent crime (e.g. police, prison, courts, etc.) as well as the amount of crime taking place. If crime is high, the resources may be few so the probability of punishment may be low. Thus, one possible Nash equilibrium is a “low-crime equilibrium” in which people believe that committing the crime will likely lead to punishment so crime is low. The other possible Nash equilibrium is “high-crime equilibrium” where criminals feel the probability of being punished is low and, thus, have a greater incentive to commit the crime.

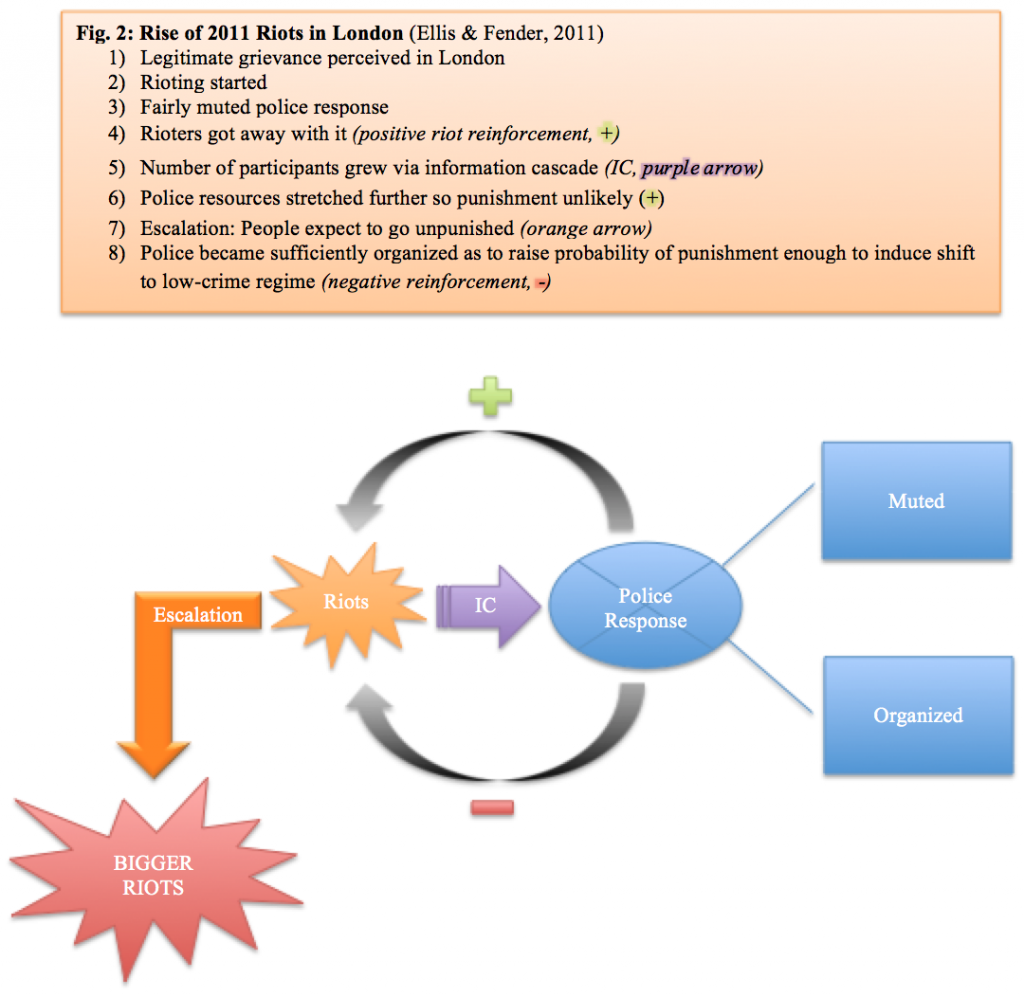

The article also brings some important issues regarding information cascades to our attention. Firstly, this mob mentality and “herd behavior” are exacerbated by the further development of information technology. Ellis and Fender state “developments in information technologies such as Twitter and Facebook are likely to make such information cascades even more powerful”. These technological advancements may have both positive and negative consequences. On the bright side, social media leads to a greater sense of unity. It creates a global society where people are not only citizens of their nation, but also of the world. Conversely, positive feedback loops diminish stability and movement towards equilibria. There is a greater likelihood of erratic fluctuations from high to low extremes. Netflix stock, for instance, experienced a period of rapidly rising prices followed by a period of rapidly falling prices. In this case, as the price rises, more people buy, which increases the price even further. On the other hand, as the price falls, more people sell, which causes the price to fall even further. Similarly, with riots in London “there was a jump from a low-crime to a high-crime equilibrium for a brief period in August and then a reversion back to the low crime equilibrium,” the researchers explained (see Fig. 2).