Income Distribution in the United States

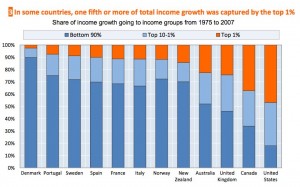

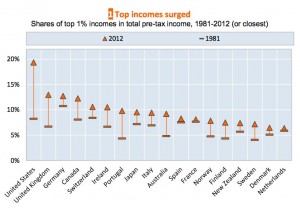

Network effects have a tremendous presence in the growth of the income gap and wealth concentration in the United States. The distribution of resources in the United States is unmatched by any other developed country and is direct result of the “rich get richer” process. The growing gap in the last few decades is becoming a more relevant topic in economics in terms of policy changes and aiding recovery. The power of the nation is mainly concentrated in this upper tier due to their popularity and presence in decision-making. There is a trap of growing importance that is seen very clearly in the documentary “Park Avenue”. In this film, the directors take a look at the variation in income that is extremely visible on a single street in New York City. As a result of Power Laws, and how information and money moves, there is a cascade and pooling of funds that takes place because of a series of events that sequentially expand and grow the gap between the two very different walks of life on Park Avenue. The initiation of these wealth effects dates back over a century. Even though the United States is a relatively young country their is old money that has carried on through time. For example the Koch brothers who presently have very large financial and political footholds, are able to have such privilege as a result of their father’s oil refinery innovation in the early 1900s. There are many other families that have similar experiences, in addition to other wealth people that gained a stronghold in money holdings. This power law phenomenon shows how popularity creates extreme imbalances and specifically in the income distribution we can look further at statistical representations of the growing gap in the United States, and how it surpasses all other economically developed countries.

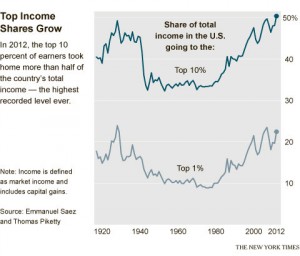

When people are asked to approximate the allocation of wealth, they guess dramatic differences between the top 10% and bottom 90%, but not nearly to the extent of reality. As seen in the graphs, over the last number of decades the concentration of wealth has been growing to striking proportions. The top 1% is in possession of 20% of GDP, and while economic recovery sparked growth, there was no trickle down effect. This exhibits the pooling of funds in the rich get richer process. The 1% used their gains to invest in increases in outsourcing and technological innovation, both of which are roadblocks to distributing the economic gains being experienced. And the decisions made are in self-interest and in the pursuit of profit but influence the economy on a grand scale. The innovation causes an increased efficiency that directly increases income for the wealthy, between 1979 and 2007 the top 1% tripled their household income, and the top fifth increased income by 65%. Despite recent growth and economic recovery, wages adjusted for inflation have remained stagnant. People’s behavior depend on other people’s behaviors, and due to the popularity and cascading decisions of the few rich, the growth that can happen at the bottom is directly limited. The richest 10% of people own 90% of the stock, and in conjunction with their influence on political policy the tax policies do not allow for equal burdens. As we observe in the data, that with current conditions the growth of the income gap is inevitable and will prevail as a representation of network effects and how the rich get richer. Immigrants originally came to the United States on a roughly even playing field, and over the course of history it is interesting to look at the network effects that developed a relatively small number of people in political, economic, and social powerhouses.

http://www.huffingtonpost.com/2014/05/01/income-inequality-charts_n_5241586.html

http://www2.ucsc.edu/whorulesamerica/power/wealth.html