Since the beginning of 2019, the Federal Reserve’s Federal Open Market Committee’s (FOMC) has begun to reconsider the wisdom of having increased its overnight policy interest rate by 100 basis point during the course of 2018, after increasing it by 75 basis points the year before. The FOMC has sent signals, with regard to its prospective actions this year, that are substantially more dovish than the guidance it delivered in 2018. The Fed’s motives may include some soft economic data and severe reversals in equity markets and long term interest rates during the last weeks of 2018[1], but it is clear that the FOMC’s approach to the policy rate in 2019 will be data dependent and far less dogmatic.

But what of the Fed’s dogmatic approach in 2018, to begin with? Clearly there was tone deafness to the markets – but was the Fed grossly misreading the overall condition of the economy as well?

This report explains why that the FOMC’s moves in 2018 were decidedly unwise – not because of the market disruptions that began in November of last year, but because of the Fed’s apparent failure to adequately appreciate the changes to inflation dynamics that have persisted over the past 15 years. In particular, the nature of inflation in the housing sector and the extent to which it has dominated the entire subject of price inflation. In short, this is not your father’s inflation.

Not only has the FOMC and, presumably, the staff economists at the Federal Reserve, ignored data they surely must observe – but they have failed to appreciate the economic feedback loops that join past and present interest rate policy to housing inflation, the transmission effects of changing interest rate policy, and the fundamental differences between inflation in interest rate-dependent capital goods, on the one hand, and that of other consumer goods and services (and wage rates), on the other.

Before moving on, in summary, here are the principal conclusions that will be explored in this paper:

- Since the end of 2013, housing – and, particularly, rents and owners’ equivalent rents of primary residences (Aggregate Rent) – has dominated both the core and all-items measure of CPI in a manner never before experienced (even during the housing bubble of the 2000s) and has distorted both measures considerably (Figure 1[2]);

- The reasons for the vast impact of residential housing rent inflation relate not to the classic demand-push inflation that would be characteristic of a post-recession recovery in employment and economic growth – but are to be found in the dramatic changes in the nature of housing demand, the supply of new housing, and slowed residential mobility since the Great Recession;

- While it is well known that the prices of owner occupied residences are related to prevailing interest rates, what is less appreciated are the connections between interest rates and multifamily housing rents – which have played a much greater role in the market since the Great Recession amidst a temporary supply and demand imbalance in multifamily housing that persisted from the end of the recession through 2017;

- An unprecedented contraction in the inventory of owner-occupied and for sale residential housing, together with a dramatic fall off (especially when adjusted for the number of U.S. households) in the availability and sales of owner-occupied housing, has produced pressures on both residential rents and prices that are not consistent, from a causal perspective, with any period of economic growth in modern U.S. history;

- Fed policy rate and quantitative easing during, and for most of, the decade since the beginning of the Great Recession sparked growth in owner-occupied home prices that, while not as dramatic of that during the housing bubble of the 2000s is once again inconsistent with the growth in prices of housing construction inputs (meaning that it represents a speculative increase in the price of land itself[3]). Such home price growth has again risen above the level of even rent-hyped inflation – to which home prices have traditionally been anchored. This is proving to be unsustainable, and housing price growth is decelerating.

The forgoing factors sit side-by-side with the prevailing state of goods and services prices excluding housing (again, Figure 1). Core goods, in the aggregate, have not contributed at all to (and have often reduced) U.S. core inflation since mid-2013 and, even prior thereto, stopped being a principal driver of overall core inflation 25 years ago with the impact of globalization outsourcing from low-wage emerging nations[4]. Inflation in core services, excluding rents and owners’ equivalent rents of primary residences, has narrowed to historically low levels only exceed during the immediate post-recession years. Finally, as illustrated in Figure 2, food and energy inflation have played a muted role in overall CPI inflation since 2012 – and are turning flat to negative as a whole with the collapse in energy prices during the 4th quarter of 2018.

These factors should not merely lead to a conclusion that “the rent’s too high.” They represent a fundamental dislocation in the relationship of housing to the overall economy and household consumption, which is rooted in phenomena that emerged long ago. It is time that the Federal Reserve took a far closer look at these factors.

This report proceeds in three sections. The first further fleshing out the impact of rents and owners’ equivalent rents on core inflation (with a nod, as well, to the Fed’s preferred core Personal Consumption Expenditures Price Index (PCE) from the Bureau of Economic Analysis (BEA)) explaining why I believe the Fed’s models over-weight rent levels and, as a result, over-emphasize the inflationary impact of low unemployment and growth in aggregate payrolls. The second section laying out the reasons for highly inflated rent levels that are not connected to economic expansion, but to those earlier phenomena. And the third discussing a macroeconomic theoretical approach to analyzing the impact of inflation emanating, however indirectly, from the price movements of capital assets in the case of this report, in residential real estate.

Housing and Inflation

This study was designed to tease out data related solely to rents and owners’ equivalent rents of primary residences – Americans’ homes – seeking to remove noise related to second homes and seasonal housing (components of aggregate rent data in the CPI) and other forms of shelter such as hotels and student housing. The data also avoids use of avoid the CPI’s special housing aggregate that incorporates costs related to utilities, furnishings, etc. It should be noted that rents and owners’ equivalent rent (OER) have risen substantially in relative importance to the CPI over the past three decades (Figure 3), comprising a 30.3% total weighting in contrast with 32.9% for shelter as a whole and 41.8% for the housing aggregate, as of November 2018.

Now, what are these twin indicators of primary residence rents, what do they tell us and how do they differ? And how do they relate to the 62.7% of housing units that are owned, rather than rented?

The 45.3 million rental units in the U.S. housing markets are relatively simple to assess – although the Bureau of Labor Statistics (BLS) conducts a large survey[5] of 32,000 units in 87 separate pricing areas in order to do so, every six months. The rents utilized are contract rents, which the BLS converts to economic rents via certain adjustments related to included utilities and other charges. The CPI data then calculates periodic changes (with relevant estimates for the months between surveys) to the rents in its sample and weights them relative to overall consumer spending.

Owners’ equivalent rents are another matter entirely. Because the purchase of a home is not considered consumption but investment (although some academics have begun to question that assumption[6] since the collapse of the housing bubble of the 2000s), home purchases are not a component of any inflation index. Yet, unquestionably, a household is offsetting a consumption expense it would otherwise have (rent), by owning its place of residence. And the cost of carrying an owner-occupied home is certainly a major portion of any such household’s monthly expenses. So how does the BLS address this seeming dichotomy?

Instead of attempting to replicate a household’s actual carrying costs (mortgage interest, real estate taxes, insurance, etc.) which would vary widely among different households, the BLS surveys owner-occupied households with a relatively simple question: “If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?” It then compares changes in those answers between polls, for comparable properties, and extrapolates results between polling dates. The BLS does not regularly publish a time series in connection with the above, but does publish a comparison to housing inflation data compiled by the BEA using National Income and Product Accounts (NIPA) data.[7]

The data obtained in this fashion is, of course, somewhat imprecise. But over the period prior to and since the introduction of OER to the CPI in 1983, the BLS has developed statistical references to actual rents that bear on the information collected from owners. The data is then tracked on a similar basis to that of conventional rent data and weighted much more heavily than such rent data (3x the weighting of conventional rents) representing the predominance of home ownership over rental households in the U.S.

The key question, to be addressed more fully in the next section, is what is the relationship between owned-home prices and rent expectations for those residences? Do such expectations merely track comparable rentals in like-markets, or do tend to more greatly reflect the prices paid/carrying costs for owned properties? And how do changes in interest rates (and interest rate policy) impact these issues? But I will get to that later on.

Now that we have established exactly what we are looking at when we talk about rents and OER, we can go back to looking at how those two elements of inflation have come to dominate aggregate measures.

First let’s make a pit stop to address the differences between core CPI and core PCE inflation, the Fed’s preferred barometer of inflation. PCE inflation generally runs “cooler” than CPI due to the differences in methodologies used in computing the respective indices. These differences rest primarily in two categories (although there are others): (i) in weighting among items, CPI focuses more on a basket of goods and services reflecting those on which households are spending, while PCE is constructed around what businesses are selling, and (ii) PCE includes expenses not actually paid for by consumers (third party expenditures, such as those on healthcare) and allows for the concept of consumer substitution among items. Of these two, it is the first that is relevant to this study.

Both CPI and PCE incorporate rent and owners’ equivalent rent into their calculus. But given the different scope of PCE, the weights given to these two items in PCE are far lower than in the calculation of CPI. That is a principal reason why core PCE has tended to often run dramatically lower than CPI in the post-Great Recession period. While lower weighted in the calculation of PCE inflation, rents and OER are hardly absent. Rent and OER of primary residences together comprise just over 15% of the all-items PCE basket, while the same weighting for all-items CPI is nearly twice as much – at 30%, as shown in Figure 3. The BEA’s method of imputing OER is entirely different from that of the BLS, and is based on a “rent-to-value” approach which assumes that an owner-occupied unit having the same value as a renter-occupied unit will have an identical rental value. But PCE housing inflation has its own problems in that there is almost no data on single family units and the market value thereof, and the Census data on which the BEA relies was last complied in 2001 (with extrapolations used ever since).[8]

But even at a far lower weighting and with all the inconsistencies outlined above, the acceleration in the growth rates of rent and OER have eventually exerted a gravitational pull upwards on core PCE, as shown in Figure 4.

The foregoing factors present perceptional problems especially when met with sizable gains in employment that would normally result in rapid household income growth. It is tempting to see rent and OER increases as only the result of higher levels of demand. But despite recent glimmers of meaningful wage growth (mostly in lower wage, lower hours employment sectors) and the longer term reduction in U-3 unemployment to historically low levels, median U.S. household income in 2018, adjusted for inflation, remained less than 4% higher than it was at the turn of this century, 18 years ago (see Figure 13).

So there is something else going on here. As Figure 5 illustrates, the contribution of rent and OER to core CPI inflation hit a historic high of 81% in the summer of 2017. While such contribution moderated some in 2018, it remains the lion’s share of core inflation and is again increasing in proportion.

This begs another question, what would be the level of core inflation without price growth in rent and OER? There was evidence at the end of Q4 2018 that rents declined nationwide on an annual basis for the first time in more than six years, according to the Zillow Group real estate database[9]. Now this data, if the trend continues, will take some time to percolate through to the BLS and BEA data – even longer for it to migrate from rents to OER estimates – but if it persists it will clearly result in materially lower inflation data in 2019. Far lower than the FOMC was banking on to support its monetary policy actions of 2018.

Examining hypothetical CPI in the absence of rental price growth is a bit of a conundrum insofar that reduced spending on rents might migrate to other sectors and create pricing pressures there (or might, in contrast, merely be saved/applied to reduction in household debt). And relative weights would change regardless. But it is worth taking a peak at what core CPI would have looked like over the past few years in the absence of primary residence rent and OER inflation, holding relative weights constant and assuming no price effects from migration in spending, as illustrated in Figure 6.

Inflation in primary residence rent is not the “whole show” when it comes to core inflation, and other core services showed signs of life in 2018 before subsiding towards the end of the year. But this one sector has dominated inflation calculus as never before. And removing it from such calculus reveals core inflation averaging just over ½ of 1% during the past 30 months.

Now let’s move on to examine why rents and OER have moved on a different trajectory from other goods and services.

Why Rent and OER Have Inflated Disproportionately to other Sectors of the Economy

Following the housing price bubble of the 2000s, and the crisis and Great Recession it ultimately produced, the U.S. housing market has been left radically changed. And so have many U.S. households. While, nominally, housing prices have “recovered” to levels consistent with bubble-high levels in a number of markets, after adjusting for inflation they are up only 10.7% off their March 2012 lows (Figure 13). Yet inflation in rents and OER are vastly outstripping inflation levels in other sectors. Why?

The answer is to be found in a confluence of the following phenomena:

- Following the housing market and mortgage collapse of 2008–2012, and despite lower unit prices, many households were forced from the owner occupied housing market and into the market for rentals.

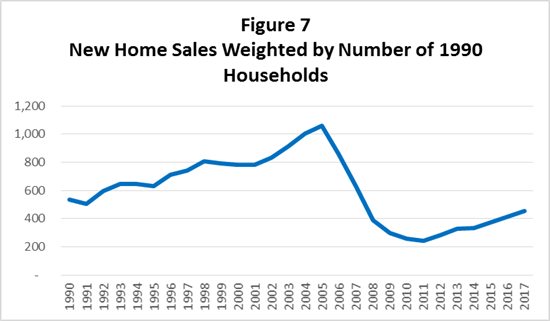

- Weighted by the number of U.S. households, the production and sale of new homes remains far below historical levels, to say nothing of the bubble era of the 2000s (Figure 7). This reflects, among other things, the inability of a sizable portion households to acquire homes, regardless of price.

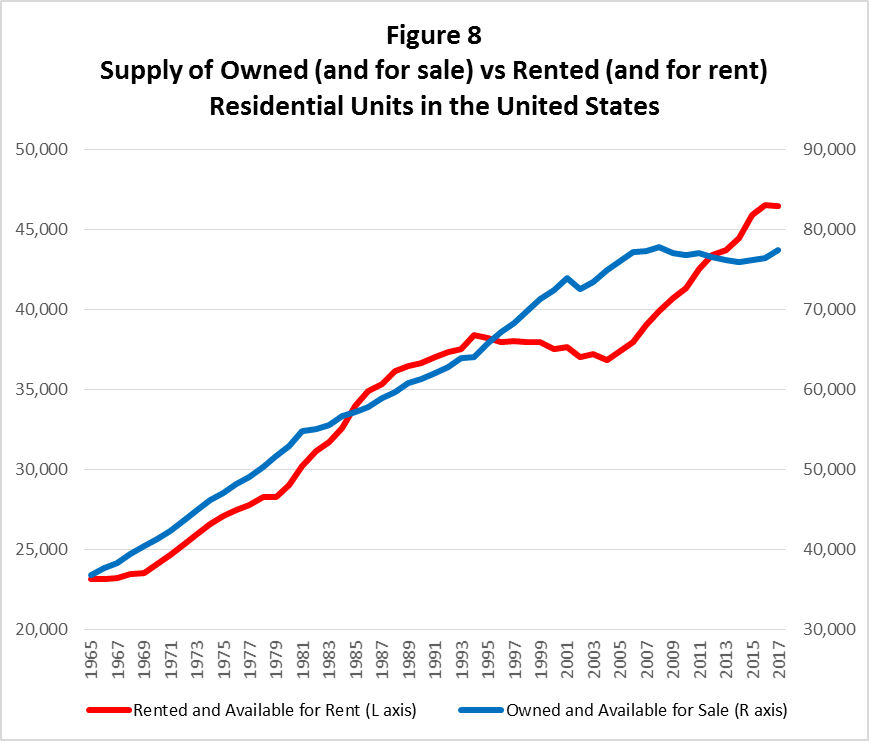

- For the first time in modern history, the nation’s entire inventory of homes owned or available for sale has been declining (due to low production and obsolescence). And this has been going on for over a decade, since peak levels in Q4 2007 (Figure 8).

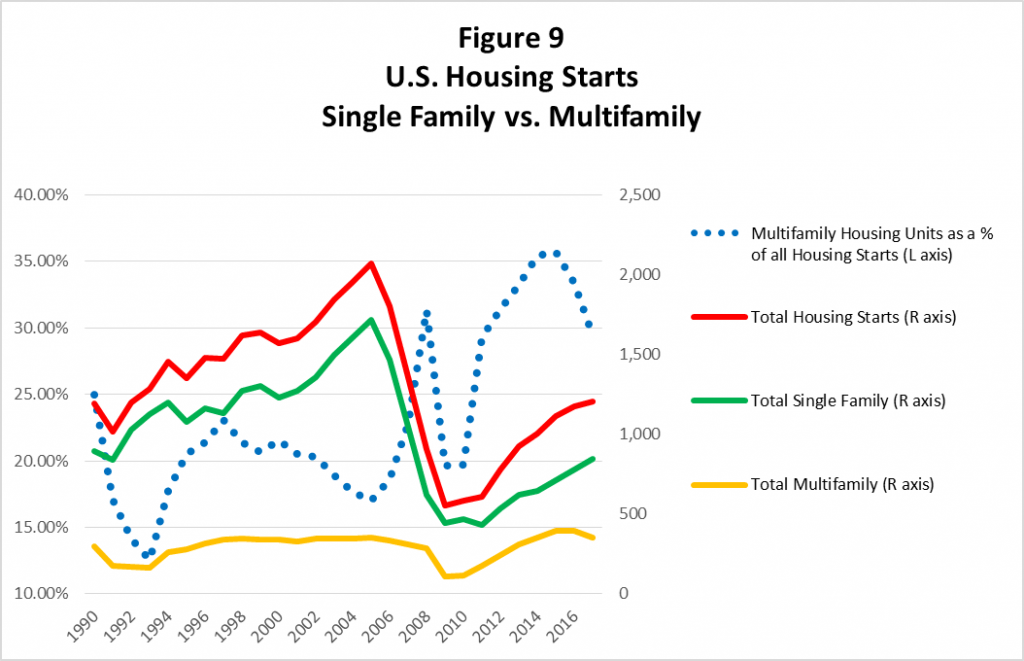

- While multifamily housing starts (mostly rentals) have recovered to their historical levels and trend growth, they have not come close to offsetting the massive decline in single family housing starts (mostly owner-occupied) that have not yet recovered to its nominal level of 1990 (when there were 27% fewer households in the U.S.) (Figure 9).

- The very policies of the Fed with regard to interest rates, had the unintended consequence of reviving a bubble in home prices (albeit far smaller than the bubble of the 2000’s) that truncated the period of renewed affordability of owner-occupied housing, limited its production and put greater – and, in the long run, unsustainable – pressure on rents and OER.

These factors persist, over a decade since the beginning of the housing crash and 6.5 years since the nadir of home prices in the U.S., despite historically low interest rates on both household and commercial mortgages that largely prevail to this day. While outstanding household mortgage balances are thankfully well below their bubble-era highs on both a nominal and an inflation-adjusted basis, mortgage origination has not even recovered to its level of 1990 when adjusted for inflation – as a result of stagnation in the inventory of owner-occupied housing as well as other issues (Figure 10).

These echoes of the housing crisis transmit to rent and OER growth through the complex interrelationship of housing supply and demand, the bifurcation of demand for shelter between owning and renting, new housing cost inputs, interest rate policy (and non-policy related factors affecting the cost of capital), real household income levels, and access by households to housing finance (and the form of such finance including, among other things, required equity down payments).

These would appear to be a very large number of moving parts to permit a consistent analytical framework. But there are a number of historical realities that underpin the present situation, which make such analysis a bit easier.

We know, for example, that as housing values plummeted from 2007 through mid-2012, many households (some of which should not have owned homes to begin with) were thrust out of the owner-occupied market. And many more, experiencing unemployment, adverse credit events and similar misfortune, as well as facing more stringent equity down payment requirements, were not able to enter the owner occupied market. This resulted in a much greater demand for rental housing which, unsurprisingly, resulted in increasing rents throughout the country.

Low interest rates on construction loans and stable construction costs throughout the period enabled a recovery in multifamily rental housing starts, which rose from a historical average of 20%, to 35% of all housing starts in 2014 (and ~30% today) (Figure 9). And the very recent downward trends in residential contract rents (as discussed earlier) is most assuredly the result of some overbuilding, along with improvements to household employment situations and balance sheets permitting a modest number of additional households to acquire homes.

So the economics of rental housing since the crisis is pretty easy to appreciate – a surge in demand, insufficient supply, a huge pickup in construction and the inevitable overbuilding along with circumstances leading to a moderate demand pivot to owner-occupied housing. Having said that, the stickiness of residential rents leads to long adjustment periods. Whether they have built new projects in high demand markets (paying a premium for the land to do so) or they have acquired or refinanced properties at premium valuations, Landlords find it difficult to be very elastic when it comes to adjusting rents downward following a boom – often coming up against loan covenants that could result in serious difficulty in the face of declining rent rolls. In some markets, such as New York City (See Figure 11)[10], landlords resort to granting “concessions” to tenants – months of free rent – instead of reducing contract rent. As concessions build to higher than normal levels the difference between effective rents and the contract rents become more material than nationally-collected data are capable of reflecting in real time. So we not only see price stickiness in its conventional sense, but also in connection with the way the data is gathered and reported.

Yet, slowly but surely, contract rents do adjust – and they are presently doing so. Which will, in 2019, slowly filter through to rent inflation data.

Rent of primary residence, as I mentioned earlier, is only about ¼ the combined weighting of rent and OER, as a percentage of CPI. Owners’ equivalent rent is a far more complex thing to understand, as is the relationship between the two rent factors.

Let’s start with the connection between owner-occupied housing and owners’ equivalent rents. As described in the prior section, OER is determined by asking homeowners what they think they would receive as rent for their property. This is a somewhat loaded question and it has a material connection to both (i) the overall rental market surrounding a given property, and (ii) the value that the homeowner ascribes to his home, what the homeowner paid for it, or both. As noted above, the polling related to OER is only conducted every six months, so there is considerable lag in the data obtained, as well.

As with landlords of residential rental real estate, owner-occupants of housing are constrained by the realities of existing carrying costs: operating costs, mortgage payments, real estate taxes and insurance premiums – with the latter three items being direct or indirect expressions of property values/costs. An owner would not be likely to imagine a rent that would not allow him or her to recover all of the above monthly costs, along with some element of profit (or at least a premium related to the inconvenience of needing to live somewhere else). To the extent a reporting owner is familiar with the subject property’s local rental market, and the same influences the response data, any tightness in the rental market – such as that described above – would also positively influence the respondent’s assessment of the rental property’s value. This can be looked at as a manifestation of the “endowment effect” – in this case not just the typical tendency for a home owner to believe their house is worth more than a potential buyer is likely to think it is worth – but a belief that it would attract more in rent than the market is actually willing to pay.

As it turns out, however, it is typically not what either a seller or buyer believes a property to be worth that determines its value. Rather, it is the cost of carry of homes that is historically the principle driver of the prices thereof. In 2016, Gianni La Cava of the Bank for International Settlements estimated that lower interest rates in the U.S. drove over half the increase in both U.S. housing prices and rents (relative to non-housing prices) and the share of nominal spending on housing, especially in supply constrained areas.[11] This can be seen in correlation (to which I attribute causation) between falling prevailing rates of interest on 10 year U.S. Treasury obligations (over which much of the mortgage market is priced) and rising growth in U.S. home prices from the mid-1980s onwards (Figure 12)[12]

The remaining determiner of house prices is household income. And, of course, interest rates and the growth rates of real household incomes are usually very much positively correlated. Low real household income growth would typically result in lower interest rates which, for a time at least, would support housing prices. A sustained period of low real household income growth and low interest rates (especially once they reach the zero lower bound) would, ceteris paribus, result in either a reduction in the pace of creation of new inventory or a reduction in home prices. As this study has demonstrated, we experienced the former for much of this decade, and are only now coming up against limits on price growth, which have been exacerbated by recent Fed interest rate policy. We have, today, extremely low inflation in the production costs of new owner-occupied housing – so that’s not a limiting factor in its production. And while real median household income has stabilized and even risen some, it is still pretty much at its level of the turn of the century. So why have real housing prices and OER continued to increase until very recently? See Figure 13 for an illustration of the foregoing, but the answer to the previous question is: Land.

Figure 13 illustrates the degree to owner-occupied home prices in the U.S. have outstripped inflation and real growth in construction costs and median household income. It does so by restating the various indices used in the diagram to a 1995 value of 100. The only absent input, logically, is the land on which homes are built. As I wrote in February 2011, “…the real source of the [2000’s] bubble in housing was the value attributed to, and/or paid for, land.[13]” The same notion applies to the “bubblette,” evidenced in Figure 13, from mid-2012 through its apogee in mid-2017. Land is a limited commodity with zero mobility and limited uses (agricultural in some places, housing and commercial construction). It returns nothing in its unimproved state and often has costs attendant to ownership (such as real estate taxes). To an extent, it is like gold as a commodity (gold being more mobile, land having ultimate potential uses in production that outstrip gold’s industrial or ornamental uses). And much like gold, lower interest rates make land cheaper to hold and therefore more valuable. But unlike gold, land can generate real and economic rents which – to the extent of the ability of the market to absorb same, tend to rise with the increased cost thereof.

The Federal Reserve’s near-zero policy rate and quantitative easing policies from 2008 to 2014, together with strong global demand for U.S. sovereign debt of all maturities, that continues to this day, unquestionably staunched the rapid decline in home prices (i.e. sustained the capital value of land) that ran from mid-2006 through mid-2012, but also restarted real price growth in housing that, once again, saw such growth flow though substantially to the rentier or seller of land.

And therein lies the rub. Owner-occupied housing affordability, especially in large (and mostly coastal) markets, has deteriorated, staunching the demand for, and production of, same to record low levels. Rising land prices, together with a dearth of affordable owner-occupied housing placed upward pressure on rents until rents, too, have come up against affordability limits. It should be noted, in all fairness, that housing starts (of all types) have slowed (net) for 60 years, when adjusted for the number of U.S. households. But, as Figure 14 demonstrates, not only did the collapse in the level such adjusted housing starts following the 2000s fall by an unprecedented 72% but, unlike after prior homebuilding recessions, its recovery has been anemic at best.

Now there have been some U.S. households that have benefitted enormously from low interest rates. 53.6 million, of the 127.5 million, U.S. households that have mortgage debt have seen their carrying costs fall substantially and have enjoyed greater household wealth. Another 30.0 million homeowners without mortgages have benefitted from the wealth effect alone. These factors have undoubtedly contributed to the economic recovery – perhaps even serving as the principal driver thereof. But not only do we have 45.3 U.S. households that have been unable to feast at this particular trough, because they are renters, but the foregoing factors with regard to rent, OER, owner-occupied housing prices, and land have distorted the inflation landscape as discussed herein.

Finally, while sustained increases in housing rents and OER cannot endure to the extent that they continue to outstrip present muted levels of real household income growth, the Fed’s response to core inflation so highly skewed to rents and OER poses an obvious problem: In attempting to address a lopsided and transient inflation problem, the central bank not only risks damage to the economy at large (and asset values in particular), but risks exacerbating already all-time low housing production.

So how should the Federal Reserve be thinking about these issues differently, so as to avoid future error in policy?

Stripping Asset Inflation from General Measures of Inflation – A Macroeconomic View

Dean Baker, of the Center for Economic and Policy Research in Washington, wrote a very useful report (June 2018) on the gap between the special Shelter index (reported as a component of CPI) and core CPI itself (whereas this report focuses on the contribution of primary residence rent and OER to CPI and core CPI)[14]. In it, Baker argues that it would be appropriate to remove shelter in its entirety from both CPI and PCE measures of inflation. While there are elements of broad shelter, such as hotel and student housing rents, that should be regarded as purely consumption expenses, there is as ample a reason for removing primary residence rent and OER from core measures of inflation as there is for disregarding food and energy prices – albeit a different one.

Whereas food and an energy are eliminated from core because of the inherent volatility of their prices (especially intra-year), the reasons for taking a jaundiced look at primary residence rent and OER – especially in setting interest rate policy and in setting market expectations with regard to the future of such policy – can be found in the following statement: Real estate is a capital asset which, while it may do double duty in providing service as shelter and, as noted previously, is priced mainly as a reflection of the cost of the funds needed to acquire and hold it (as opposed to the nominal costs of producing it). Hence, interest rate policy is tied to a feedback loop through the housing channel that – especially in the extreme cases – could theoretically result in multiple outcomes dependent on exogenous factors.

The foregoing conundrum can be viewed along the lines of Hyman P. Minsky’s writing on the “two-price systems” that are inherent in capitalism (reflecting an expansion of earlier work by John Maynard Keynes, Knut Wicksell and Irving Fisher). Minsky wrote that: “There are really two systems of prices in a capitalist economy – one for current output and the other for capital assets[15].” The price system for current output is, generally, reflective of supply and demand factors we are all familiar with. But the price system for capital assets operates not only in a relative sense with regard to current output (if price of current output is lower than the price of capital assets, it makes sense to invest in more capital assets and, if vice versa, fewer, resulting in recession) but is also as an expression of the availability and the real cost of capital.

And, unlike what we have seen over the course of this century to date, the cost of capital during expansions following recessions (even major recessions) would be expected to accelerate in expectation of the future inflation that such an expansion, and absorption of the excess supply and resources generated during recession, would eventually produce. As supply of new capital assets grows, rising inflation would typically align the prices of inputs (commodities, labor and services) used in the creation of new capital assets, with the higher prices of capital assets that were initially engendered by low post-recession capital costs.

When Minsky wrote in the 1980s, after the across-the-board hyperinflation of the 70’s and resulting hyper-tightening policies of the Federal Reserve to stem same, the foregoing (while not fully accepted in mainstream economics) was an astute insight.

But what happens if – as with so many phenomena during this globalized “age of oversupply[16]” that features a persistent excess of output and capital relative to demand – higher inflation of the cost inputs related to the production of capital goods never really materializes in an expansion? And, as a result, interest rates remain low? Under such circumstances, does reduced competition for capital – in the absence of inflation in the prices (and values) of general goods, services and labor – foster the production of an ever growing inventory of capital assets?

The answer, given the events of the past decade, appears to be no. While Minsky may not have conceived of such a set of circumstances (he passed away in 1996), the disinflationary trend that has been a core feature of global economy since the emergence of the enormous post-socialist economies, has produced outcomes that Minsky would have easily recognized and understood within the rubric of his two price system.

What he would have seen is leakage. Because in the present era output costs are in fact low, which should drive new production of capital assets. And, miraculously, global capital costs are persistently low as well. Accordingly, we should be producing capital assets like crazy. And “we” are…elsewhere.

Capital investment in the U.S. (and other developed nations) remains depressed. Even the Trump administration’s much vaunted Tax Cut and Jobs Act of 2017 produced nothing more than a momentary flicker of capital spending[17], now extinguished. Yet capital spending in emerging nations (including China, among others) is over twice that of the U.S. even with the aforementioned deficit financed tax cuts. That is hardly surprising inasmuch as the U.S. has shipped so much of industrial production abroad and is running an industrial capacity utilization rate at an all-time low level for late in a recovery (Figure 15).

With low capacity utilization and new capital spending come fewer higher quality jobs. With fewer higher quality jobs comes sub-par household income growth and low levels of domestic inflation reflecting (i) the absence of pricing pressure occasioned by rising wages as well as (ii) the continuing influx of goods from lower cost producing nations. With a low quality jobs (low wages/low hours) growing faster in the U.S. relative to higher quality jobs, there is less production of new owner-occupied housing leading to all the phenomena previously addressed.

And while U.S. demand is supporting employment elsewhere and, in 2018, the U.S. racked up a goods trade deficit with foreign countries of $719 billion[18], our housing market would generally be considered entirely a domestic affair. But, as discussed earlier, to the extent that existing housing prices and rents inversely correlate with the persistent low interest rates that are the product of the foregoing (and the related global capital glut), the one thing that would normally make housing more plentiful and affordable (low capital costs) eventually serves to drive a speculative bubble that yields distortions and supply constraints – at least temporarily.

Minsky’s two-price system is as relevant an analysis of capitalism in a low inflation, low interest rate environment as if was during hyperinflation and tight money. The bottom line – with respect to today’s situation – being that the influences of real capital costs on capital assets, when combined with persistent sourcing of current output abroad yields a mismatch between asset-related and non-asset-related inflation.

Since the upper bound of rents and OER must, in reality, be anchored to the ability of shelter seekers to pay them (i.e. the level of disposable household incomes), growth in rents is dependent on growth in household incomes. As we have seen, when the rate of growth of rent and OER substantially outstrips the rate of growth in household incomes (as it did in the 2000s and, again, recently) rent and OER growth must stall and then readjust. Putting aside the financial systemic and GDP growth implications of that outcome, it should be clear that using a current inflation rate dominated by rent and OER growth – as a proxy for the trend of future inflation – is fraught with the potential for grave error.

Using such an error-prone measure to determine central bank policy rates (and, in the present instance, the application of quantitative tightening measures) could be catastrophic and engender multiple unintended outcomes – among them, for so long as land prices remain sticky (and they tend to be very much so), the exacerbation of an already existing shortage of affordable housing. And it may be that to “unstick” land prices requires deep recession (as we saw in the 2000s), which would render a continuation of Fed policy during 2017-2018 as a classic example of a successful surgery during which the patient dies.

Central banks need to pay greater attention to the two price systems in the economy and allow for high levels of rent and OER growth to peter out based on factors of supply and demand, before setting off alarm bells regarding risks of harmful inflation.

[1] Hopefully not also motivated by harangues emanating from the current occupant of the White House.

[2] All figures used in this report are sourced from Bureau of Labor Statistics data, and the author’s calculations, unless otherwise indicated.

[3] See Figure 13 and related discussion.

[4] While not solely responsible, the near-total absence, or negative impact, of core goods (core commodities) on aggregate inflation, arising from globalization, has been a driving factor in increasing the impact of housing sector of rent and owners’ equivalent rent on over inflation data for decades. See, further, Alpert, Daniel, The Age of Oversupply: Overcoming the Greatest Challenge to the Global Economy, Portfolio Penguin, New York, 2013, Chapter 1.

[5] For additional detail, see https://www.bls.gov/cpi/factsheets/owners-equivalent-rent-and-rent.pdf

[6] https://www.businessinsider.com/wharton-professor-home-not-an-investment-2016-10

[7] Katz, Arnold J.. Imputing Rents to Owner-Occupied Housing by Directly Modeling Their Distribution, Bureau of Economic Analysis, August 2017, pages 3-4

[8] Ibid, pages 2-3

[9] https://zillow.mediaroom.com/2018-10-18-Rents-Decline-Annually-for-the-First-Time-in-Six-Years

[10] Courtesy of Miller Samuel Inc., used with permission.

[11] La Cava, Gianni, Housing Prices, Mortgage Interest Rates and Rising Share of Capital Income in the United States, Bank for International Settlements Working Papers, July 2016

[12] N.B. The mid-2000’s housing price bubble itself, so clearly apparent in Figure12, can itself be attributed in part to synthetically created temporary low payment rates on mortgages offering teaser rates, so-called “Option ARM” mortgages and other “affordability products” designed to enable housing prices to increase far beyond levels justified by prevailing interest rates or comparable rental levels.

[13] Alpert, Daniel, Beyond the Double Dip in Home Prices, Westwood Capital, New York, February 2011, Page 8

[14] Baker, Dean, Measuring the Inflation Rate: Is Housing Different?, Center for Economic and Policy Research, Washington, June 2018

[15] Minsky, Hyman P., Stabilizing an Unstable Economy, New Haven, Yale University Press, page 143

[16] Alpert 2013, op. cit.

[17] Foroohar, Rana, US Capital Expenditure Boom Fails to Live Up to Promises, Financial Times, London, November 2018

[18] https://www.census.gov/foreign-trade/balance/c0004.html