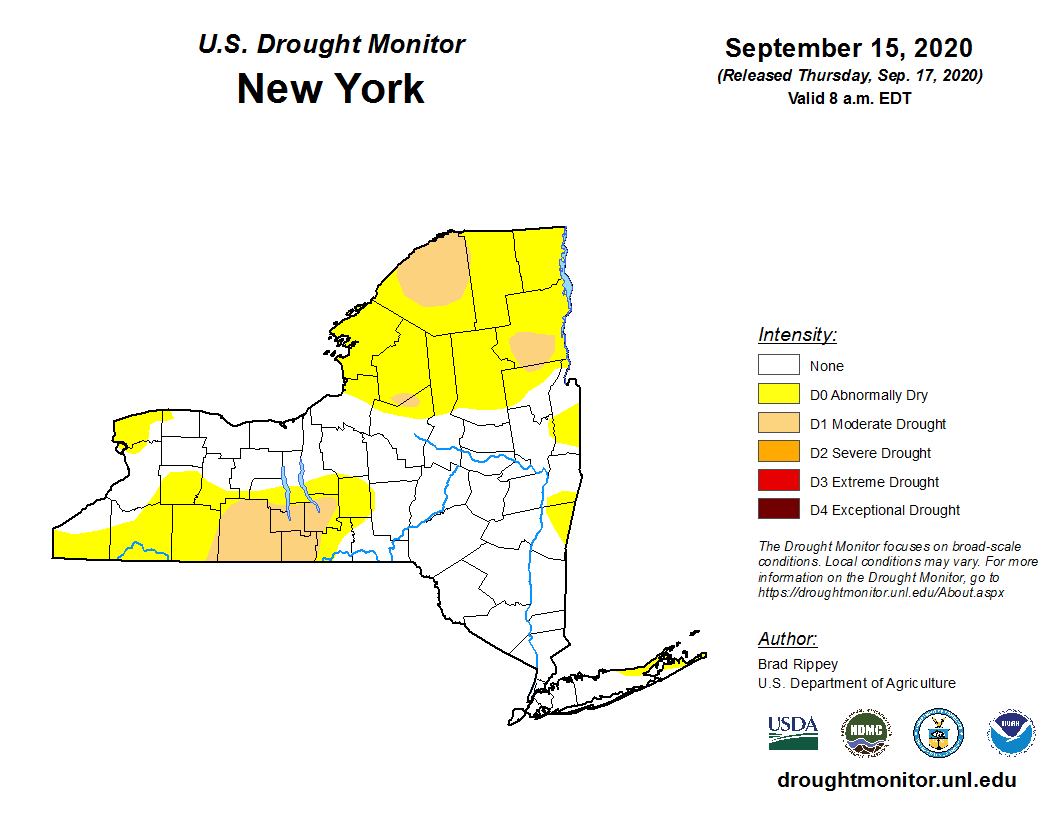

Pasture Rangeland and Forage (PRF) crop insurance was developed for producers that produce forage for their animals or for sale. It covers the single peril of drought. The basis of this insurance is on data collected by the National Oceanic and Atmospheric Administration (NOAA). Their historical records for precipitation go back 50 years, which allows them to calculate the average rainfall for an area. When the rainfall for the period chosen by the producer falls below the average rainfall plus a deductible, an indemnity check is mailed to the producer. The sales closing date is November 15, 2020. This leaves farmers a short time to learn about the policy and decide whether it would help their farms. The following are some of the basics of the policy.

Steps to Insuring With PRF

PRF is considered a “Group Policy” which means there are no requirements for farms to submit their actual production history.

The first step when working with a crop insurance salesperson is to identify on a map the “grid” where the farm is located. Each grid is 0.25 degrees in latitude by 0.25 degrees in longitude or approximately 12 miles by 12 miles. Once the Grid Number for a farm is identified the next steps are making the following choices:

- Establish an insured guarantee by using the Hay or Pasture county rates. Hay rates vary across the nation. For central NY, rates run between $250 – $300/acre and pasture rates are much less. Contact a Crop Insurance Agent for your county’s actual rates. Multiplying the farm’s forage acres times those rates will result in the guarantee. The higher the guarantee the higher the cost for insurance but also the higher the indemnity payments.

- Choose a “Productivity Factor” which allows a producer to raise or lower the county rates of the forage. The range is between 60% and 150%. For example, if my farm is certified organic I may wish to increase the value of the forage from $285/acre to $427/acre.

- Choose the interval months where the coverage is in place. Each interval is 2 months long and producers must choose at least 2 intervals to put their acreage into. Producers can choose up to 6 intervals for coverage year round.

- Select the “trigger” precipitation for the intervals chosen. The trigger is the percentage of precipitation the producer chooses that they will receive an indemnity. The NOAA average precipitation is designated as 100. If the final precipitation for the interval was listed as 80 that would mean the rainfall was 20% below the average rainfall. If it was 110 the precipitation would be 10% more than average.

Producers do not have to insure all acres. Insurance payments are determined by using NOAA CPC data for their grid(s) and index intervals that were chosen to insure. When the final grid index falls below the policyholder’s “trigger grid index”, the producer may receive an indemnity. This insurance coverage is for a single peril — lack of precipitation. Coverage is based on the experience of the entire grid. It is not based on individual farms or ranches or specific weather stations in the general area.

My Farm Example:

- I have 90 acres of pasture which can also be harvested for hay. I chose to cover it at the Hay Value so my guarantee would be: 90 acres X $285/acre = $25,650

- I did not raise or lower the County Value so it remains at $285

- I wanted to have year round coverage so I put 25% of my guarantee into the May/June interval, and 15% in every other interval. The total was 100%.

- I chose the highest “trigger” which was 90. If any of the intervals had a precipitation of less than 90% of average rainfall, I would have received an indemnity check.

The cost of this policy with no subsidy was $2,335. The USDA pays a premium subsidy for most crop insurance as a way to encourage farmers to participate in their programs. For the policy I described above the subsidy was 51% which brought down my cost for the policy to $1,144.

I have used PRF in the past. Most years I don’t get many indemnity payments. The exception being the drought years when it helped the bottom line for my farm immensely. That is the goal of crop insurance, it’s better to have a normal year where your crops yield well but on those years where weather just doesn’t provide a farm with good growing conditions it’s nice to have the insurance to help sleep at night and keep from experiencing a disaster.

Enrollment Deadline is November 15, 2020

The PRF enrollment deadline for the 2021 growing season is November 15, 2020. All transactions and policy contracts need to be completed by a certified Crop Insurance Agent. These agents are also an excellent source of information about this policy. Use this link to view a list of crop insurance agents in your area: https://www.rma.usda.gov/tools/agent.html

You can use the USDA’s PRF decision support tool to find your grid and explore historical rainfall data at https://prodwebnlb.rma.usda.gov/apps/prf

That was interesting

درمان ویروس کرونا