Cartels and Their Network of Information

Previously in class we have discussed networks and more specifically how networks of information pass information like job opportunities from one individual to another. On a greater scale this is also how businesses and criminal organizations communicate. Networks in criminal organizations function the same way with information being slowly circulated. Most economists seem to believe that cartels fix prices through frequent sharing of information within the network. However, in a study done by professor Takuo Sugaya, an associate professor at the Stanford Graduate School of Business, and Alexander Wolitzky, an associate professor in MIT’s Department of Economics, challenges the common belief offering an idea that too much transparency within the cartel may actually help outside firms undercut the prices of cartels and therefore gain market shares.

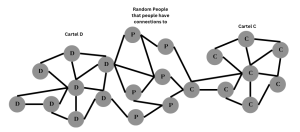

The reasoning can be explained using a network of information, suppose there are strong ties within each cartel member. Within this network there are bound to be some members that have weak ties to people outside of the cartel, as shown in figure below, and these individuals could have connections that lead to a bridged connection to members of another firm that are looking to undercut the prices of the cartel and gain control over the market. So it isn’t unreasonable to think that by frequently interacting between members of the cartel that some information about prices may end up in the hands of the competition. Therefore, professor Wolitzky proposes the idea that cartels actually limit their communication between other members of the cartel to coordinate fix prices using the example that cartels “use intermediaries to only distribute the small amounts of information” to the individual members therefore limiting the amount of information that is passed over the bridged connection.

Figure:

The study also notes that the proposed idea is not true for all cartel models and some businesses may deviate based on different circumstances. Wolitzky hypothesizes that for volatile markets it is necessary for more transparency to produce more accurate predictions about future sales. However, for less volatile markets where consumer demand is consistent, cartels may want to be more decentralized and communicate less. Recently, the cartels have been extorting lime farmers in Mexico in an attempt to control the price of limes. They employ a less transparent system of communication in order to prevent rival cartels from beating them in the market. One such practice they employ is limiting the amount of days that farmers are allowed to harvest the limes which limit the supply of limes contributing to the increase in price of limes in the United States. If this cartel had used a more transparent system of communication the enemy cartels would’ve gained access to the information through the bridged connections described and undercut this cartel’s prices. Therefore, it was the optimal strategy for this cartel to be less transparent. Learning about how the network of information functions helps understand how cartels and other organizations operate.

Sources:

Link to the summary of the study: https://news.mit.edu/2018/cartels-collude-alexander-wolitzky-1219

Link to video by Business Insider on Limes:

https://www.youtube.com/watch?v=VsyvKC2TwrM&t=431s&ab_channel=BusinessInsider