General Electric: Go Long or Wait?

Source: https://seekingalpha.com/article/4287957-general-electric-prisoners-dilemma

General Electric has been predicted to have extraordinary year in terms of market revenue growth. The article debates to purchase stock from General Electric. Under normal circumstances, it would have been a good idea to invest in the company, given the astonishingly undervalued price of investment. However, recently, financial fraud investigator and whistleblower Harry Markopolos published a report that suggested that General Electric may be committing fraud for $38,000,000. After this news was released, the stock price quickly dropped in response for the next couple of months and it is unclear whether this trend will continue or not or as the article says, “it could just be the tip of the iceberg”.

This situation can be simulated using a game theory chart of payoffs for possible outcomes. In fact, this example somewhat resembles that of the prisoner’s dilemma example.

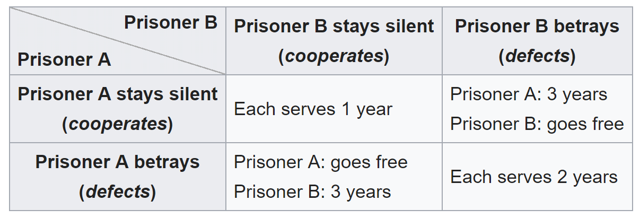

The nature of this game is a situation where two prisoners have the choice to either stay silent or confess(betray) and it is assumed that the two individuals have no loyalties between each other. In this situation, the only Nash Equilibrium is both prisoners betraying each other since these two decisions are both best responses to each other. However, if the prisoners were to have both stayed silent, it would have resulted in a better scenario for both. However, given whatever the other player chooses, it is always a better choice to betray the other, resulting in this the prisoner’s dilemma. This is a dilemma because the best response would be a situation that results in a non-optimal result for either party.

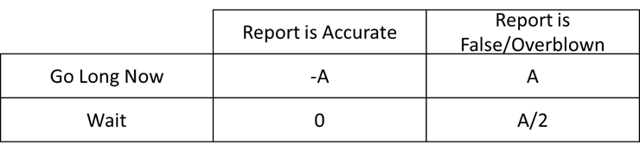

Returning to the topic, there are two possible scenarios for the effect of the report. Either the report turns out to be false/overblown, or the report is accurate. The choice is difficult because if we decide to purchase the stock and the report is true, we would be hurting ourselves but if we didn’t purchase the stock and the report was false, we would be missing out on a pretty big opportunity. This situation is different from a normal prisoner’s dilemma since there is only one player making a single choice since the report cannot choose whether it is accurate. In this case, it may be a better strategy to wait so that we at least eliminate the possibility of being hurt by our choice. Like the prisoner’s dilemma, we should choose a less optimal situation so that we have smaller but more certain profits.