Port Strategy using Game Theory – Singapore and Malaysia

The Straits of Malacca is one of the busiest shipping lanes in the world. In particular, the region is home to Malaysia and Singapore, which dominate the inter-port industry (i.e. Port of Singapore (PSA) – 2nd busiest globally; Port Klang, Malaysia (PKL) – 11th busiest globally; Port Tanjung Pelepas, Malaysia (PTP) – 19th busiest globally. As a Singaporean, this has always made me question whether there is room for cooperation between the three ports. To be fair, there is nothing unique about location between the three ports. Yet, PSA handles 1/5th of the world’s shipping containers. This is in spite of the fact that the use of PSA is more expensive compared to PKL and PTP due to the strong Singapore currency and relatively higher wages. What Singapore has instead is a strong reputation for respecting the rule of law, ensuring safety and security, and as a reliable and established transshipment hub. How then should the three different ports interact considering that Singapore has a clear advantage over PKL and PTP. The research paper above uses game theory to conclude that cooperation between PSA and PTP “generates greater profitability to the current hub and spoke network” while PKL “should not commit to any cooperative strategy”.

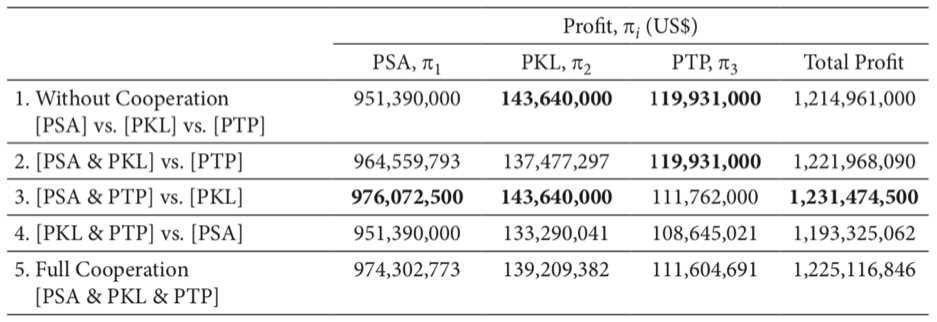

Below is the payoff matrix for PSA, PKL and PTP:

From the matrix, it is evident that the maritime industry would reap the greatest profit should PSA and PTP cooperate without PTP. The strictly dominant strategy for PSA would be to cooperate with PTP, albeit temporarily, with each other. For PTP, it has some “bargaining power” while in an alliance with PSA because it can earn higher profits without any cooperation while PSA would experience a decrease in profit. Meanwhile, PKL would retain the same profit should there be no cooperation (no strictly dominant strategy). This could be due to the fact that PSA has experienced a decrease in transshipment volumes, taken by both PTP and PKL. Nonetheless, Singapore has upped the ante by developing the Tuas Mega Port, which is capable of handling larger volumes and containers while utilizing more advanced technology, thus reducing costs for vessels. Therefore, the future payoff matrix seems to tilt in the favor of PSA.