In Defense of “Market Professionals”

In many discussions of the role of information cascades in markets, traders are often portrayed as “lemmings” who are uninterested in the real economic signals, and instead simply try to ride information cascades either on the way up or on the way down. Many researchers have pointed out how this “irrational” behavior can be harmful (Keynes), and others have argued that the behavior is essentially rational (Banerjee). But most of this research has essentially viewed investors as a homogeneous mass of decision makers, while in reality, there are many different types of investors. In the 2006 paper “Information Cascades: Evidence From An Experiment With Financial Market Professionals”, the researchers (Alevy, Haigh, and List) created an empirical laboratory experiment to compare the behavior of professional stock traders from the Chicago Board of Trade and college students. Their results indicated that professional traders were more likely to make use of their private (market data) signals, and to more rigorously evaluate the quality of the public signals. This behavior meant that the professionals were involved in a slightly lower number of cascades in general, and a significantly lower number of downward cascades, when compared to the college students. These findings offer some support for the claim that “market professionals” perform a useful service for society: because professional traders make more use of private data, and are more resistant to participating in negative cascades (possibly because they aren’t overly loss-averse), these professionals help make the market both more robust and a better reflection of economic realities.

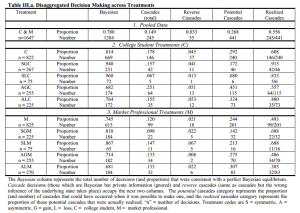

The experiment was designed to be similar to the classic “urn” experiment used to model information cascades. The researchers recruited 55 students and 55 traders, who drew balls from symmetric and unsymmetric urns, and were either subject to gains or losses based on the correctness or incorrectness of their choice. 15 rounds of draws occurred. While overall, the amount of money earned or lost by market professionals and the students was statistically the same, the professionals and the students exhibited significantly different behavior. The professionals were “less Bayesian” in their decisions than the students, and exhibited learning between rounds. In addition, different types of traders behaved differently, with traders who held their shares for longer being much less likely to enter cascades, defying Bayes rule. The market professionals manage to do as well as the students, while still going against Bayes rule, because they learned to properly discount the value of early announcements. The authors of the paper speculate that the heterogeneity of behaviors among market professionals is what prevents and reduces the severity of information cascades in the market. Thus, this research may imply that even though “market professionals” may not make you any more money when they manage your money, they may make the market as a whole better.

Source: http://www.nber.org/papers/w12767.pdf