Have you ever heard the business adage: “You can’t manage what you don’t measure?” When it comes to the financial side of your farm business, good record keeping is the first step to measuring — and managing — business performance.

Good financial record keeping takes time, discipline, organization, and often teamwork. For some farms, it may also require investing in accounting software, or hiring a professional bookkeeper. In other words, you have to commit resources to this effort, and the commitment must be ongoing. However, with all of the day-to-day production activities demanding attention from the farm operator, it can be easy to lose track of that commitment.

If the benefits of good record keeping are not enough to convince you that the effort is worthwhile, then consider the costs of poor record keeping. In my experience, farms with inadequate financial record keeping systems face three major costs: wasted time, missed opportunities, and high stress. While it may be difficult to quantify these costs, they are very real. When you spend hours searching for a lost bill or receipt, incur service fees due to a missed payment, or overlook an opportunity to increase profits, both your financial bottom line and your mental health can suffer.

What makes a good record keeping system, and how do you know if you already have one or not? This short quiz can help you answer both of these questions. The five quiz questions encourage you to reflect on attributes of your current record keeping system. Keep track of your points to see how your system ranks, and what you can do to improve it, in the scoring section following the quiz.

Rate Your Record Keeping Quiz

On my farm, records of individual income and expense transactions are:

- Regularly entered into an accounting system before going into organized storage (3 points)

- Organized, stored in a specific location, easy to find (2 points)

- Disorganized, stored in multiple locations, hard to find (1 point)

Which statement best describes the accounting system used to enter and track financial data on your farm?

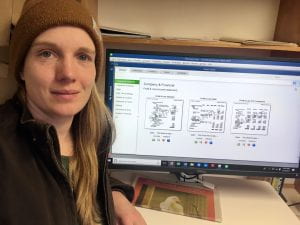

- We regularly enter financial transactions into a digital accounting program — e.g. QuickBooks, CenterPoint, Quicken, etc. (4 points)

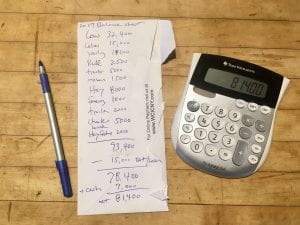

- We regularly enter financial transactions using a simple accounting tool — e.g. Cornell Farm Account Book, Excel spreadsheet, etc. (3 points)

- We use checking account statements as the primary record of financial transactions — e.g. the digital shoebox method (2 points)

- We collect paper receipts and hand them over to an off-farm accountant at the end of the year — e.g. the shoebox method (1 point)

Who is responsible for financial record keeping on your farm?

- One person is responsible, and that person sets clear expectations for other team members (3 points)

- Multiple people share responsibility, and their roles are not clearly defined (2 points)

- Nobody (1 point)

Which statement best describes the income tax situation on your farm?

- The farm completes income tax returns on a timely basis (3 points)

- We are still working on last year’s taxes (2 points)

- Our farm is more than a year behind on filing income taxes (1 point)

Our farm generates and uses financial statements to analyze business performance:

- Regularly, on a monthly or quarterly basis (4 points)

- Regularly, on an annual basis (3 points)

- Only when our lender requires it (2 points)

- Not at all (1 point)

Interpret Your Score

5 – 9 points: Poor

Your record keeping system is inadequate. It may be costly in terms of high stress, inefficient labor, and missed opportunities. Your farm desperately needs someone to make a commitment to take your system to the next level. To set up a basic system, you will need to identify who, what, when, where and how. Who will be responsible for organizing records and entering transactions? What categories will you track for revenues, expenses, and other transaction types? When will your designated bookkeeper complete their record keeping activities? Where will records be stored, whether in digital or print format? What accounting tool will you use to record transactions? If you are more than a year behind on your record keeping, you may consider using a simple accounting tool to catch up quickly, while putting a more sophisticated tool into place for future years.

10 – 14 points: Adequate

You have a basic record keeping system in place, which most likely satisfies the IRS and your banker, and helps with farm decision making. However, your system may not provide enough detail or accuracy to analyze your farm’s financial performance. It is time to ramp up your record keeping game, and build a system that creates more value for your business. Do you have the in-house capacity to manage a sophisticated record keeping system? If so, invest in training for whoever on the farm is responsible for record keeping. Explore different accounting software packages, and discuss their pros and cons with your tax accountant and your lender. Select a record keeping software that works for you, one that is simple enough for your on-farm bookkeeper to learn and manage, yet sophisticated enough to analyze data and generate financial reports. If you do not have a person on the farm who can provide leadership for a record keeping transition, consider hiring an outside bookkeeper to enter transactions on a weekly or monthly basis.

15 – 17 points: Rock Solid

You have reliable numbers to support detailed financial analysis. You can plan and make management decisions with confidence. Once your record keeping system reaches this level, you can shift your focus from data tracking to analysis. At this point, you should have a strong foundation for whole farm budgeting and strategic business planning. Be sure to set clear financial goals and review your profitability on a regular basis, whether monthly, quarterly or annually. Consider benchmarking your financial performance against other farms in your industry to identify opportunities for improvement. The agricultural extension program in your state can help you locate benchmarking resources for your industry. Ultimately, your farm will benefit from your ability to evaluate financial impacts of possible changes, and plan for the future of your business. Depending on where you are in the lifecycle of your business, it may be time to start developing a farm succession plan.

I scored 13.5 points!

I took the quiz and rated a 13.

I scored a 16 but we do not use the records on a regular basis for decision making.