Plants need water to photosynthesize and grow. No hay producer or grazer would disagree with this statement. Yet if I asked a group of farmers what they do in the absence of rain, and how they manage hay and pasture yield risks associated with low rainfall, I know I would hear a variety of answers.

The USDA Risk Management Agency (RMA) Pasture, Rangeland and Forage Insurance (PRF) program is one risk management tool that producers can use to protect their operations from low forage production due to lack of precipitation. With the November 15 enrollment deadline rapidly approaching, this article describes the program in detail and provides instructions on how to purchase coverage.

If your farm produces hay, or grazes livestock on pasture, then you are eligible for PRF coverage. PRF is a national program, with policies available for every county in New York, and in all 48 contiguous states. Unlike single crop insurance, which compensates producers for yield or revenue losses relative to their own production history, PRF compensates farmers for below normal precipitation (rain or snow) in their area. PRF is a true “single peril” insurance product because low precipitation is the only cause of loss that it covers.

How does PRF work?

PRF utilizes a Rainfall Index to determine precipitation levels for coverage purposes. An index value of 100 indicates normal precipitation, based on a historical average. An index value above 100 means conditions are wetter than normal, while a value below 100 indicates that conditions are dryer than normal. The Rainfall Index is a proxy for forage production, but it does not measure direct production or loss. Producers who use PRF are insuring a Rainfall Index, not their actual production.

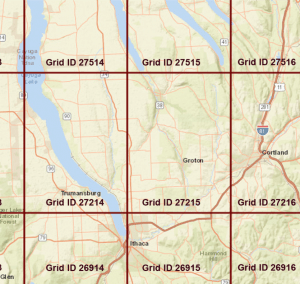

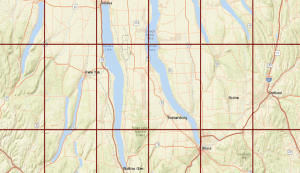

The Rainfall Index uses National Oceanic and Atmospheric Administration (NOAA) data, which utilizes a grid system to determine precipitation amounts within an area. The grid is 0.25 degrees in latitude by 0.25 degrees in longitude, which translates roughly to a 13 by 15 mile rectangle in New York State. Your crop insurance agent can help you find the grid number and historical rainfall data for your location. You can also access this information online using the Grid Locator from RMA’s Pasture, Rangeland and Forage Support Tool: https://prodwebnlb.rma.usda.gov/apps/prf

Insurance agents will assign a farm’s hay and pasture acres to one or more grids based on the location of the insured acres. Producers do not have to insure all of their acres. However, producers cannot insure more than the total number of insurable (hay and pasture) acres. If you graze and cut hay on the same ground, you can choose whether to enroll those acres as hay land or pastureland, but not both.

PRF coverage requires the producer to select a coverage level, a productivity factor, and two or more index intervals. Each index interval represents a two-month period, and producers must select at least two non-overlapping intervals. For risk management purposes, the intervals selected should cover the period when precipitation is most important to a producer’s operation.

Policyholders can select a coverage level from 70% to 90%. The coverage level determines the trigger point for an indemnity payment. Low precipitation will trigger an indemnity payment if the final Rainfall Index drops below the coverage level in any of the chosen intervals. The higher the coverage level, the greater the probability of an indemnity payment.

Let’s look at a hypothetical example. Imagine that a producer chooses the 90% coverage level for two intervals: July-August and September-October. In this case, the Rainfall Index will trigger an indemnity payment if the final value is below 90 for one or both intervals. In this example, assume the actual precipitation was higher than normal in July and August, but lower than normal in September and October. The final Rainfall Index for July-August was 110, which does not trigger an indemnity payment. However, the final Rainfall Index for September-October was 70, which triggers an indemnity payment for the September-October interval.

If the Rainfall Index triggers an indemnity payment, the amount of the payment depends on a number of variables: county base value, productivity factor, coverage level, final Rainfall Index value, and total number of acres insured. RMA establishes a base value for pasture and hay land in each county. Hay land generally has a higher base value than pastureland. For instance, in Cortland County the base value for pasture is $54 per acre, while the base value of hay land is $380 per acre.

Producers can adjust the base value up or down by selecting a productivity factor between 60% and 150%. The dollar amount of coverage per acre is equal to the product of the county base value multiplied by the productivity factor multiplied by coverage level. So, if a Cortland County producer chooses a 150% productivity factor and a 90% coverage level for hay land, the dollar amount of coverage per acre will be $380 x 1.5 x 0.9 = $513.

Producers must allocate a percentage of their total coverage into each of their chosen index intervals. For instance, if a producer selects two intervals, they could place 50% of coverage in each of the two intervals, or they could place 70% of coverage in one interval and 30% in the other. As you can see from these two examples, the percent of coverage in each interval must add up to 100% for the year. The total value of protection in each two-month interval is equal to the product of the amount of coverage per acre multiplied by the percent of coverage allocated to that interval multiplied by the number of acres enrolled.

To illustrate, let’s assume our Cortland County producer, who had a dollar amount of coverage equal to $513 per acre, purchased PRF to cover 100 acres of hay land. The producer allocated 60% of coverage to the July-August interval and the remaining 40% of coverage to the September-October interval. The total protection for the July-August interval would be $513 x 0.6 x 100 = $30,780. In contrast, the total protection for the September-October interval would be $513 x 100 x 0.4 = $20,520.

To determine the value of a premium payment, PRF generates a “payment calculation factor” by subtracting the final Rainfall Index from the coverage level, and dividing that difference by the coverage level. Continuing with the previous examples, let’s say our final Rainfall Index was 110 for July-August and 70 for September-October. At the 90% coverage level, the index does not trigger an indemnity for July-August, but it does trigger an indemnity for September-October.

Let’s calculate the indemnity payment for the September-October interval. The payment calculation factor is equal to the coverage level minus the final Rainfall Index, divided by the coverage level, or (90 – 70) / 90 = 0.222. We multiply this value by the total protection for the September-October interval to produce an indemnity payment of 0.222 x $20,520= $4,555.44. Thus, this producer who enrolled 100 acres would receive an indemnity payment of $4,555.44.

Given the choices outlined in this example, the estimated premium that this producer would have paid to enroll in the program would have been $2,778. In this case, the producer ends up with a positive net payment after subtracting the premium of $4,555.44 – $2,778 = $1,777.44.

These examples are only intended to illustrate how the PRF Insurance program works, and do not guarantee similar results.

Perks of Using PRF

In addition to protecting your farm from production risks associated with low precipitation, I can think of 10 features that makes PRF especially farmer-friendly.

- Recordkeeping is not required.

- You never have to file a claim.

- You choose the number of eligible acres that you want to enroll.

- If you receive an indemnity payment, the program will issue it automatically.

- Indemnity payments are usually made 4 months after the end of the index interval.

- Indemnity payments may help you purchase feed when forage yields are low.

- You do not have to pay your insurance premium when you sign up. You will be billed in September of the following year.

- The federal government shares in the cost of actuarially fair insurance premiums. More than half of the PRF premium cost is subsidized.

- You can work with the private crop insurance agent of your choosing.

- Lenders like to see farmers using crop insurance as part of an overall risk management strategy.

Purchasing PRF Insurance

Farmers work with independent crop insurance agents to purchase PRF policies. There are dozens of agents located in New York. You can find a list of insurance agents within 50 miles of your farm using the RMA Agent Locater tool: https://prodwebnlb.rma.usda.gov/apps/AgentLocator/#/

November 15, 2019 is the deadline to purchase a policy for 2020. However, you won’t be billed for your insurance premium until September 2020. Call or visit your crop insurance agent well in advance of the deadline so you have time to gather information and make an informed decision.