The 2018 Farm Bill authorized the Dairy Margin Coverage (DMC) program, a new tool that dairy producers can use to manage price risk. DMC is a redesigned version of the Farm Service Agency’s old Margin Protection Program (MPP), and it shares many of the same features. It also incorporates new features intended to lower the cost of coverage and increase the highest coverage threshold, particularly for small and mid-sized dairies.[1]

Dairy farmers no longer have to choose between enrolling in FSA’s DMC and utilizing USDA’s Risk Management Agency (RMA) insurance programs. New rules allow dairy producers to utilize DMC in combination with the RMA’s Livestock Gross Margin for Dairy (LGM-Dairy) or the newly created Dairy Revenue Protection (DRP) programs.

According to the USDA Farm Service Agency (FSA), which administers the DMC program, sign-ups for DMC will run from June 17 to September 20, 2019. This means data will be available to calculate your actual DMC benefit payments for the first few months of the year, under various coverage levels, before you sign up. This transparency should help farmers make the best possible coverage decisions.

How it Works

DMC pays “cash subsidies to dairy farmers when they experience a squeeze between the price of milk and the cost of buying feed to produce that milk.”[1] The margin in Dairy Margin Coverage refers to the difference between the price of milk and the price of feed. FSA also calls this the “milk margin above feed costs” and the “income over feed cost margin.”[2, 3]

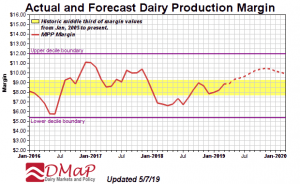

The USDA calculates an Actual Dairy Producer Margin (ADPM) on a monthly basis using prices for All Milk, corn, soybean meal, and alfalfa hay. Participating farms receive a benefit payment for any month in which the ADPM drops below the farmer’s chosen threshold.

In order to participate in DMC, dairy farmers must make two key choices: how much milk to cover, and at what threshold.

What Coverage Level Should I Choose?

Under DMC, you can choose a Coverage Level Threshold between $4.00 and $9.50, in 50 cent increments. The threshold is important because it determines whether or not you receive a payout. Your farm will receive a benefit payment if the actual margin for a given month drops below your chosen threshold. The higher the threshold, the higher the probability of a payout.

If a payment is triggered, your chosen threshold affects the amount of the payment you receive. Your threshold also influences your premium (cost) to enroll in the program.

The USDA has released an online decision tool to help producers determine the right level of coverage for their farm. This tool allows producers to evaluate different scenarios under various DMC coverage levels. Farmers should refer to their local FSA office to clarify any specific questions they might have.

How Much Milk Should I Cover?

Farms can choose to enroll between 5% and 95% of their production history under DMC. Any farm that participated in the old MPP will maintain the same production history for DMC. The same methods used to calculate production history for MPP will be used for any new farms joining DMC.

The amount of milk that you cover does not have any effect on your chances of receiving a benefit payment. However, it does affect the total cost to participate in the program, as well as the total value of benefit payments, if you receive any.

How do I Sign Up?

Visit your local FSA office between June 17 and September 20 to enroll for 2019. You must pay a $100 administrative fee plus a premium payment. The total premium is calculated by multiplying the premium fee ($ per cwt) for your selected coverage threshold by the total amount of milk (cwt) that you elect to cover.

There is no premium for the lowest threshold, which triggers a benefit payment if the ADPM drops below $4.00. This level of coverage is known as catastrophic coverage because the margin that triggers a benefit payment is so small.

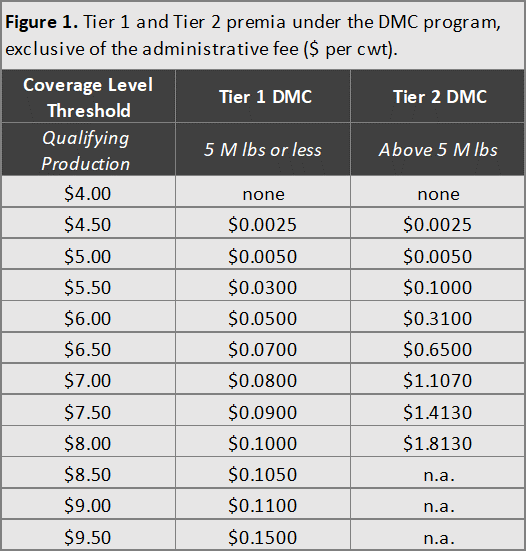

Premium payments for threshold levels above $4.00 depend on two things: your chosen threshold and the amount of milk you cover. Premium prices are set on a per cwt basis. Tier 1 prices apply for up to 5 million pounds of milk, while Tier 2 prices apply to milk over 5 million pounds.

Tier 1 premium fees range from $0.0025 per cwt for coverage at the $4.50 threshold, up to $0.15 per cwt for the $9.50 threshold. Tier 2 premium prices are higher than Tier 1 prices, and coverage levels for Tier 2 stop at the $8.00 threshold.

Discounts and Credits

The DMC rewards farms that previously participated in MPP by providing a credit worth 75% of their past MPP premiums paid minus the total MPP benefits received. If this applies to you, FSA can credit this amount toward the cost of any new premiums when you sign up for DMC in 2019 or beyond. Alternatively, farms that choose not to use their credit toward the DMC program may request a cash refund equal to 50% of their past MPP premiums less their total benefits received.

DMC also rewards farms that commit to long-term enrollment with coverage levels locked in. This means you can get a 25% discount on annual premiums if you enroll for a five-year period. The farm must commit to the same threshold level and the same percentage of historic production for the full five years to receive this discount.

Farmers that USDA classifies as limited resource, beginning, veteran, or socially disadvantaged are exempt from paying the $100 administrative fee.

Calculating Benefit Payments

The USDA Farm Service Agency has released their Actual Dairy Producer Margin (ADPM) values for January and February 2019.[2, 3] The milk margin above feed costs was $7.99 in January and $8.22 in February. Thus, producers that select a threshold of $8.50 or higher are guaranteed to receive DMC payments for January and February 2019.

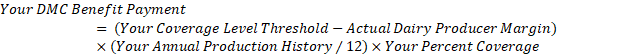

When a payment is triggered, the payment amount is determined by a simple formula. Subtract the ADPM from your coverage threshold level. Then multiply the resulting value by your annual production history divided by 12 months per year. Finally, multiply that by your percent coverage level.

Example

For example, let’s take a hypothetical dairy milking around 250 cows, with a production history of 5,000,000 pounds (50,000 cwt) per year. Assume the dairy enrolled the maximum amount of milk at the maximum Coverage Threshold Level. This means they chose to cover 95% of their production history at the $9.50 threshold.

The amount of milk covered under DMC is equal to the farm’s production history of 5,000,000 lbs x 0.95 = 4,750,000 lbs, or 47,500 cwt. This value is less than the 5 million pound limit, so all of this milk will be classified as Tier 1.

The Tier 1 premium for the $9.50 threshold level is $0.15/cwt, so the farm’s total annual premium is $0.15/cwt x 47,500 cwt = $7,125. This is the farm’s cost to participate in DMC in 2019, excluding any possible credits, discounts, or administrative fees.

Since FSA has released the actual margins for January and February 2019, we can calculate this farm’s benefit payments for these two months, given their choices outlined above.

The Actual Dairy Producer Margin in January was $7.99. This triggers a payment, because the ADPM was less than the farm’s coverage threshold of $9.50. Using the formula provided, we can calculate the farm’s January DMC benefit payment as ($9.50 – $7.99) x (50,000/12) x 0.95 = $5,977.08.

The ADPM for February 2019 was $8.22, which was below the $9.50 threshold. This triggers a monthly benefit payment equal to ($9.50 – $8.22) x (50,000/12) x 0.95 = $5,066.67.

To summarize, this hypothetical dairy paid an annual premium of $7,125 to enroll in the 2019 DMC program. The farm received benefit payments for January and February, worth a combined total of $11,043.75. This results in a net gain of $3,918.75, with potential for additional DMC payments during the remaining 10 months of the year.

References

- Novakovic, A.M.; Stephenson, M. (11 December 2018) Dairy Margin Coverage – the new margin protection plan for dairy producers. Dairy Markets and Policy Briefing Paper 18-2.

- USDA Farm Service Agency. (25 March 2019) USDA Announces January Income over Feed Cost Margin Triggers First 2019 Dairy Safety Net Payment.

- USDA Farm Service Agency. (18 April 2019). USDA Announces February Margin Triggers Second 2019 Dairy Safety Net Payment.