Information Cascade and Tuilp Mania

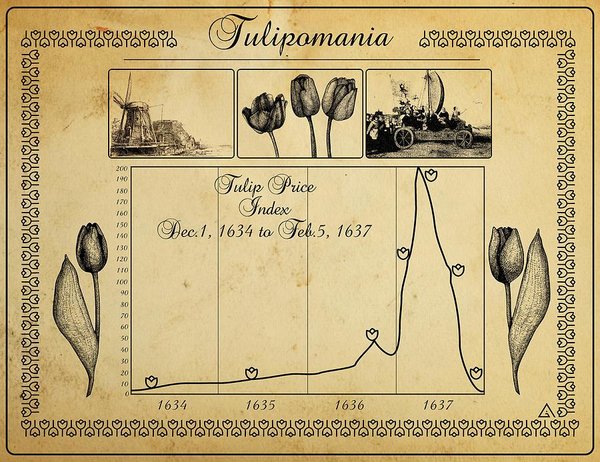

Tulip bulbs first arrived in Holland at the end of the 16th century. They initially caused great excitement due to their exoticism and so they quickly became status symbols. This was the beginning of “Tulip mania”, one of the most famous bubbles in financial history. While the beginning of the meteoric rise in Tulip prices could be attributed to the social status that one gained by owning them, the longevity and magnitude of this bubble can be explained in terms of an information cascade.

Information cascade is a phenomenon which occurs when people make their decisions based on rational inferences made using information about the decisions of others. At the height of Tulip mania, what continued to drive the price increase of Tulip bulbs was the fact that large numbers of people were investing in tulips. As a result, others began to believe that they may be a good investment, subsequently, they purchased Tulip bulbs themselves and drove the price up further. Eventually, in 1637 some florists decided to liquidate their investments and take their profits. Once enough of these florists sold their bulbs and failed to reinvest, the price of Tulips began to fall. Other members of the public soon followed. This was more than likely due to the fact that when members of the public saw that florists had begun to sell their bulbs, they inferred that this meant prices were unlikely to continue increasing and as a result they sold their bulbs as well, continuing the cascade.

The information that investors had regarding the future direction of Tulip prices was mostly limited to what the public opinion on Tulips was, as a result, when public opinion was favorable, investors inferred that prices would rise and bought bulbs, and when public opinion turned negative, investors did the opposite. This situation illustrates how information cascades can play an important role in financial market analysis.

Picture Source: ecotalker.wordpress.com