The 2010 Flash Crash: How information cascades shape our world.

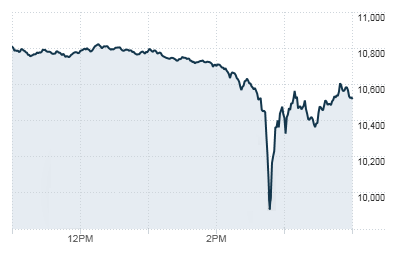

On a relatively ordinary afternoon, the 6th of may in 2010, the global financial trading system lost 1 Trillion USD in just over half an hour. After forensic analysis, it was determined the massive selloff was due to automated trading algorithms misreading market conditions due to a variety of factors and selling based on faulty information. This initial glitch created a runaway effect whereas more automated traders sold, even more programs saw the sell-off and sold their own positions as well. The market quickly recovered after human agents intervened, but the episode is a stark reminder of the unintended consequences information networks can have in supposedly rational systems.

Background:

At the time of the 2010 flash crash, high frequency traders (HFTs) were routinely taking advantage of Regulation NMS, which although designed to improve market fairness and quote accuracy, inadvertently allowed a variety of “cheats” which could be used to game the market. One particularly disruptive activity, known as Spoofing, is believed to have contributed to the crash (but whether it was the initial cause or not is controversial). Spoofing is described as a type of algorithmic trade where a bad actor places a large number of orders with the intention of altering market demand for the asset, and then canceling the orders. By utilising high frequency software the trader can take advantage of the momentary change in market attitude to purchase or sell at a better position, before the market corrects. Another problem was price incongruity between NYSE internal quote reporting and third party trading platforms, which allowed HFTs with access to the internal reports to profit off the price lag. These activities are illegal but can be hard to trace due to the distributed nature of equity markets. These phenomena created a race to the bottom as HFTs attempted to trade as fast as possible to achieve maximum profit. The massive amount of market instability created by these traders meant small trades had big ripples, and big trades could topple the entire system.

May 6, 2:45pm

Owing to the Greek debt crisis and fluctuating currency exchange prices, the market was already particularly volatile. This volatility thinned liquidity as traders worried about losing money to momentary price fluctuations. At 2:32pm, The Asset management firm Waddell & Reed Financial Inc. initiated a sell off of 75,000 E-Mini S&P futures contracts (valued at approx $4.1 billion) using an algorithmic trader. The program the firm used was instructed to sell the contracts based off the market frequency of S&P contracts being sold, but did not have any parameters regarding the sell price or elapsed time. Seizing the opportunity, many HFTs began buying and selling these contracts anticipating the saturation of the market by the large sell order. Lacking sufficient external demand, the HFTs began trading these contracts to each other in what was described as a game of “hot potato”, driving prices down. The massive amount of trades by these HFTs forced the selling algorithm to sell even faster, at lower prices. Futures market liquidity quickly dried up which alerted algorithms in the equity market to close their positions, driving prices down. In just 4 minutes, the S&P exchange had already dropped 4%.

As previously explained, glitches allowed certain HFTs to exploit the crash as it unfolded in the equity market. Algorithmic spoofing and aggressive selling strategies pushed prices even lower, sucking liquidity out and forcing many firms to pause trading. At 2:45:28, the Chicago Mercantile Exchange tripped a circuit breaker and paused selling for 5 seconds allowing participants to verify their data integrity. When trading resumed, buying pressure had increased and prices returned to true consensus values.

The Cascade

With the advent of HFTs, stock trading has become increasingly the realm of computer algorithms and educated guesses. Using the information cascade model, it’s easy to see how even a small amount of bad actors can create instability in a system which is built around the attitudes of other actors. While the real life system is more complex, it can be simplified to a model where Trader B sees Trader A either buy or sell, which may influence their own position. Each trader has their own information on the current and possible future prices of an asset, but they do not know if their information is accurate or not enough to make a decision based solely on their own findings. The introduction of spoofers could easily create cascades in the following way: Trader 1 buys, Trader 2 buys, Traders 3 through 100 “sell”. Trader 101 sees the massive amount of supposed selling, and sells their position as well. Even when the spoofer starts buying, the massive amount of sell pressure created from the fake orders will outweigh the buying for long enough for the spoofer to buy at a reduced price. A cascade can happen when multiple spoofers “sell” in conjunction with each other, creating such a large sell pressure that it outweighs the natural buy pressure and drives the price down. These cascades can be avoided or at least interrupted with the use of circuit breakers, like the one the CME used during the flash crash. The circuit breaker interrupt the decision train long enough for traders to check their own information and verify that the market activity did not line up with the true prices of the assets. This event underscores how market fairness is important for a robust economy, and how distributed and fragile networks are vulnerable to events like flash crashes.

Sources:

https://www.businessinsider.com/what-actually-caused-2010-flash-crash-2016-1

https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/2010-flash-crash/

https://www.investopedia.com/terms/r/regulation-nms.asp

https://www.sec.gov/news/studies/2010/marketevents-report.pdf