How Investors Use Game Theory to Tackle the Trump Age

source: https://www.fa-mag.com/news/game-theory-to-history-lessons–investors-tackle-the-trump-age-40919.html?section=3

Although the US market has demonstrated strong economic conditions than years ago, some investors are discouraged and often have to reevaluate their decisions due to the instability in the political landscape. Right now, according to the article, most investors are focused on the US economic expansion, specifically delineated by the steady increase in corporate earnings, low market volatility, controlled Treasury rates, and recored-high S&P Index. However, combined with the unpredictable political climate ranging from presidential tweets to tariff-imposing administrative policies, the stakes of investing is rising and investors are becoming increasingly worried about risk control and predicting future market outcomes.

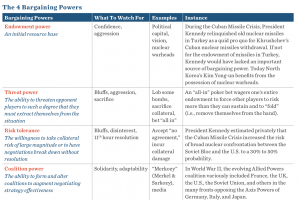

Brian Singer at William Blair, the head of the firm’s dynamic allocation strategies, uses game theory to gain insight into the motivations of decision makers and to understand likely actions and outcomes. In his Game Theory and Macro Investing Playbook (available at https://www.williamblairfunds.com/resources/docs/Content/multi-alternative/Game-Theory-and-Macro-Investing-Playbook.pdf?utm_source=AP&utm_medium=LandingPage&utm_content=DownloadButton&utm_campaign=Playbook), he defines game theory as “set of principles for scrutinizing the strategic interactions of multiple agents acting in their best interest and responding to their incentives through cooperation and conflict in response to other players’ actions”. He then outlines 3 factors that outcomes of any strategic negotiations are contingent upon: 1) players’ objectives, 2) initial bargaining powers and 3) modes of action (threats as potential punishment for failure to cooperate, promise of potential reward for cooperation and passivity). He categorically breaks down the bargaining powers into the following 4 types:  .

.

Singer also recommends using interest rates, asset prices and other input released from the Federal Reserve as indicator of the overall market performance because it is more stable and less subject to change, unlike the “noise” and other misleading/rumored information coming out of the political arena.

I decided to write about this because Singer’s risk management model is derived from the fundamental principles of game theory that we learned in class: maximizing one’s payoff based on the predicted strategies the other players will use in the game. The The scenario of investors assessing and evaluating risks of their investments utilizes the concepts of game theory but on a larger scale since they have to take into consideration a wide variety of factors, including the implications of geopolitical events on the economy, government regulation and sanction policies, monetary policies, industry trends, etc. But essentially, the ultimate goal remains the same: to maximize one’s profits. However, there are some nuances to the stock market that differs from a typical game theory setup. In a game, there’s a clearly declared winner and loser while in the stock market, it is hard to distinctly label someone as a winner or loser because the stock market increases in value over time and hence the concept of “you make money only when someone else loses money” is not applicable.