Oil Production is a Game

OPEC (Organization of the Petroleum Exporting Countries) consists of fourteen separate nations with the common goal “to coordinate and unify the petroleum policies of its member countries and ensure the stabilization of oil markets, in order to secure an efficient, economic and regular supply of petroleum to consumers, a steady income to producers, and a fair return on capital for those investing in the petroleum industry.” Recently, OPEC has been in talks with another oil producing nation, Russia, in efforts to stabilize the oil market. These talks have led to higher oil prices. Since the collapse of the oil market in 2014, many such conversations have occurred, ultimately resulting in increased oil production and decreased prices. While one doesn’t necessarily think of the oil market as a game, classic game theory can be easily applied. Production quotas are regularly set for each nation within OPEC based on market prices and available supply. However, these quotas are not always followed. This can be reduced to a simple game akin to the prisoner’s dilemma.

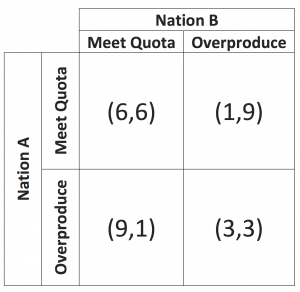

Suppose there is a game with two nations as players. These nations are part of a large conglomerate and each nation has the ability to either produce the amount of oil in its quota or to cheat and overproduce. If both nations overproduce, the market will over-inflate and the market price of oil will plummet, resulting in losses for both nations. However, if one nation overproduces and the other meet its quota, then the nation that overproduced will see significant economic benefits. Since each nation understands that if they choose to follow their quota and another nation overproduces, they will have significant losses, the dominant strategy, in this highly simplified game, is always to cheat and overproduce. If both nations do choose to follow their quotas, there is an overall economic benefit for the conglomerate.

This simple game mimics what has happened within OPEC since its conception. While oil prices remain low, the risk of not overproducing outweighs the overall conglomerate benefit. Until the price of oil rises to a point where nations are reaping large economic benefits as a whole, nations will continue to flood the market with oil through overproduction.

http://www.opec.org/opec_web/en/about_us/23.htm

http://seekingalpha.com/article/4004241-game-theory-finest-oil-production-freezes-happen