The Negative Side Of Cascading Information

Our world is crowded with people and information. Since there are so much information for us to process, it’s impossible for us to scrutinize each information carefully. Sometimes we just follow the crowd or the authority, which results in the cascade of information.

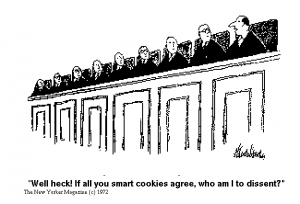

The journal “Information Cascades” mentions that “A person who is perceived to have good data/insight into the event or problem makes a decision”. This statement explains that information cascade usually starts with a prestigious person or a group makes a decision on something. It’s true that if the authority does not made any decisions, people won’t believe in other less prestigious people and therefore won’t be interested in starting the information cascade. “Other people, observing the first person’s decision, opt to avoid original analysis/discovery and copy the earlier decision” explains the process of information cascade that other people follow the action of the first person. Due to the overwhelming information, sometimes people are either too lazy to inspect every information or they are not confident enough to against the crowd to say the truth they believe. As a result, they prefer to copy the earlier decisions. The journal also mentions the bad effect of cascading information that “The more people that copy the earlier decisions, the less likely any new discovery or analysis is done”. It’s true that cascading information might prevent new invention and discoveries since nobody will be willing to say anything against the crowd’s opinion.

In lecture we learned that there are two categories of rational reasons to follow the crowd. The second category is direct benefit effect, which means that sometimes being part of a crowd has value in itself. The journal mentions that people tend to base their financial decision directly on economic theories because they believe that those theories have predictive power, even in extremely complex situation. In this case, the crowd is the people who believe in the economics theories. People tend to be in the crowd because they think the theories have predictive power which can help them make best financial decisions. However, cascading information by using these economic theories in whatever situation can be risky because the theories might not be effective in very complex cases.

From the lecture we also know that cascades are so fragile that it can be overturned by a small amount of additional info. The journal mention the Iraq war example that “information cascades can turn an attack on nominally stable social systems into a systempunkt”. Therefore, if wrong information is cascading, the result can be catastrophic.

Sources:

http://globalguerrillas.typepad.com/globalguerrillas/2008/09/journal-informa.html