New York State is Reopening, But Weekly Unemployment Claims Have Started to Climb Again

18 June 2020

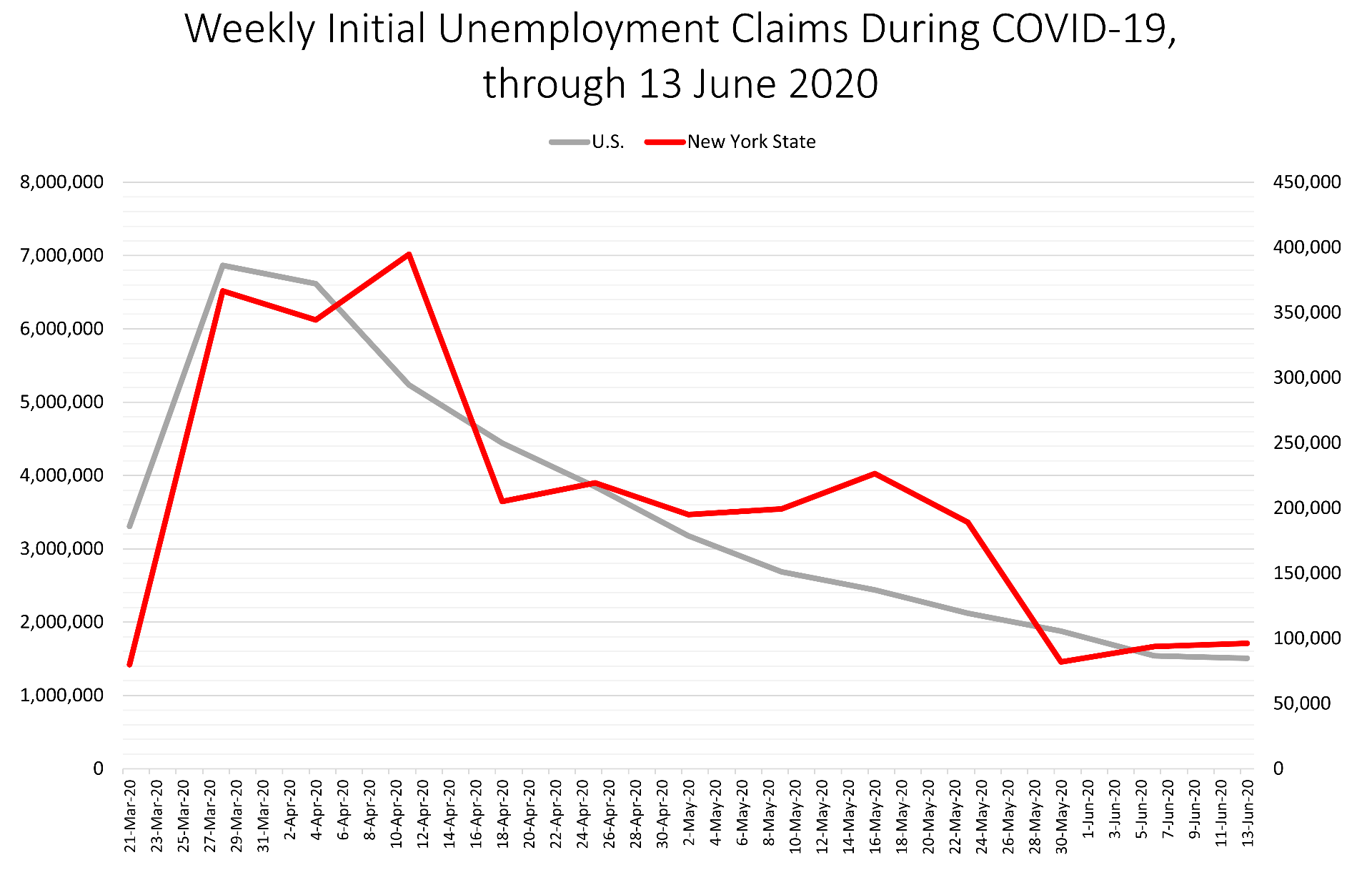

Since the start of the COVID-19 pandemic, the number of weekly unemployment insurance (UI) claims has been one of the most closely monitored and widely cited data points in the United States, arguably behind only coronavirus cases and COVID-related deaths. During the first week after mass shutdowns and statewide stay-at-home orders were issued, more than 3.3 million Americans filed UI claims – a record-shattering figure, and a 1,072% increase relative to the prior week. One week later, UI claims nearly doubled, reaching an historic peak of nearly 6.9 million across the nation.

Ever since that peak, the number of weekly claims in the U.S. has been trending downward. According to today’s release from the U.S. Department of Labor (DOL), claims have now fallen for eleven consecutive weeks. Yet, while sustained week-over-week decreases are unquestionably positive signs, the numbers are still staggering. Across the country, another 1.5 million workers filed UI claims for the week ending 13 June 2020. That’s a considerable drop off from 6.9 million weekly claims, though it is still more than five times higher than the 282,000 claims made during the week prior to onset of the economic shutdown (week ending 14 March 2020)!

Like we’ve previously reported, it is easy to become desensitized to these figures and to cheer the large drop in weekly UI claims relative to earlier in the pandemic. But just because the week-to-week magnitude of the unemployment crisis appears to be weakening does not mean that things are returning to pre-pandemic “normal” levels – nor can we afford to spotlight week-to-week improvements while downplaying cumulative effects. Concerning the latter, with the 1.5 million new UI claims reported today, the total number of unemployment claims made since mid-March has risen to roughly 45.7 million – the equivalent of 28% of the March 2020 civilian labor force.

As researchers at the Economic Policy Institute observe, these staggering totals mean that:

“Policymakers need to do much, much more to fight this recession and set our economy up for a strong recovery, which will not happen without intervention. For example, without massive federal aid to state and local governments, 5.3 million workers in the public and private sector will likely lose their jobs by the end of 2021. Further, the across-the-board $600 increase in weekly unemployment benefits, which was one of the most effective parts of the CARES Act on both humanitarian and economic grounds, should be extended well past its expiration at the end of July. We also need increased support for safety net programs, including SNAP (or food stamps). And importantly, we can’t turn off federal relief too early. The expiration of relief provisions should be tied to actual economic conditions. Assigning arbitrary end dates to provisions to sustain the economy makes no sense when there is so much uncertainty about how the recovery will unfold. Automatic triggers (where provisions phase out as the unemployment rate falls or the employment-to-population ratio rises) would alleviate the very real threat that we turn off federal aid when the economy is still too weak, hamstringing the recovery.”

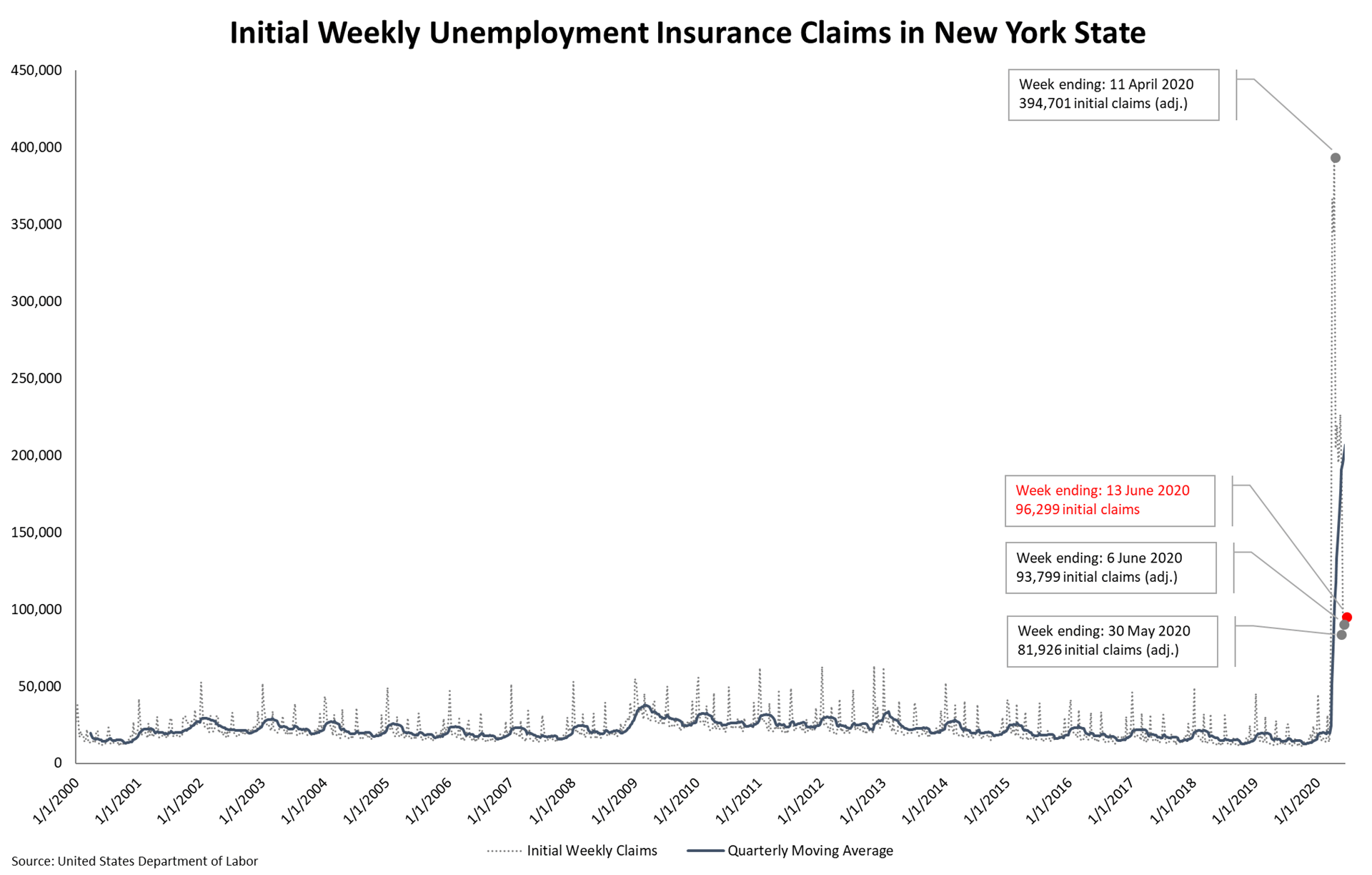

These observations are particularly relevant for New York State. Unlike for the nation as a whole, UI claims in New York have continued to fluctuate up and down since reaching their peak total in early April. Since hitting a ten-week low of roughly 82,000 new claims during the last full week of May, initial claims have now climbed for the second straight week. Today’s DOL data release reported just under 100,000 new claims in New York for the week ending 13 June 2020. These new claims raise the total UI claims made in New York to just under 2.7 million since the start of the State’s stay-at-home order. That’s roughly 29% of New York’s March 2020 civilian labor force.

Week-to-week changes in UI claims in the U.S. and New York State, since week ending 21 March 2020

| Week Ending: | U.S. | % Change from Prior Week | New York State | % Change from Prior Week |

| 21 March 2020 | 3,307,000 | +1,072% | 79,999 | +461% |

| 28 March 2020 | 6,867,000** | +108% | 366,595 | +358% |

| 4 April 2020 | 6,615,000 | -4% | 344,451 | -6% |

| 11 April 2020 | 5,237,000 | -21% | 394,701** | +15% |

| 18 April 2020 | 4,442,000 | -15% | 205,184 | -48% |

| 25 April 2020 | 3,846,000 | -14% | 219,413 | +6% |

| 2 May 2020 | 3,176,000 | -17% | 195,110 | -11% |

| 9 May 2020 | 2,687,000 | -15% | 199,419 | +2% |

| 16 May 2020 | 2,438,000 | -9% | 226,521 | +14% |

| 23 May 2020 | 2,123,000 | -13% | 189,087 | -17% |

| 30 May 2020 | 1,877,000 | -12% | 81,926 | -57% |

| 6 June 2020 | 1,542,000 | -18% | 93,799 | +14% |

| 13 June 2020* | 1,508,000 | -2% | 96,299 | +3% |

| Total Initial Claims, 21 March – 13 June 2020 | 45,665,000 | 2,692,504 | ||

| Total Claims as % of March 2020 Labor Force | 28.0% | 28.6% | ||

These upticks in New York’s UI claims reinforce the points quoted above from the Economic Policy Institute. Namely, the policy measures taken to date are not sufficient for economic recovery. As benefits – e.g., PPP funding – continue to run out with no reinforcements, continued job loss appears to be one of the prices that states like New York will pay. Additional interventions are necessary for preventing such an outcome.