Using Game Theory to Understand the Housing Crisis of 2008

As the real estate bubble began to burst in 2008, homeowners with mortgages were faced with a serious dilemma. Although their property values were declining, their mortgages remained fixed. Why should they continue to pay off the full value of their debt when their homes were worth far less? It would make more sense for the homeowners to walk away from their mortgages and let debt servicers foreclose on their homes, which served as collateral.

Choosing not to repay a mortgage despite having the money to do so is called strategic defaulting and occurs mostly when homeowners owe more than their property is worth. Some homeowners, however, choose not to default because it hurts their credit score. Others keep paying because of the moral issues they have with breaking a contract. However, the most important factor in determining whether or not strategic default is a good choice is whether or not neighbors are doing it.

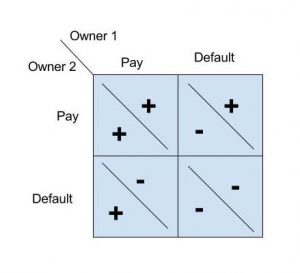

Using an example of a two home neighborhood, there are four possible outcomes that can occur, as illustrated in the payoff matrix below:

First, both homeowners can choose to stay in their homes and keep paying their mortgages. In this scenario, the overall long term health of the economy is maintained and the two homeowners can eventually pay off their debt. The payoff is positive for both homeowners.

Next, both homeowners can choose the route of strategic default. While this may seem like a good idea initially (due to the low value of the home), it comes at the cost of the entire economy. If all homeowners chose to default, collection agencies would go bankrupt and the entire flow of credit that the economy depends on would disappear. The payoff is negative for both homeowners.

Finally, if one homeowner defaults and the other doesn’t, the one who does is able to relieve some extra debt while avoiding a huge recession (because only one defaulted, rather than both). The homeowner who does not default must continue to service their debt through the mild recession caused by the other homeowner defaulting. The payoff is positive for the homeowner who defaults and negative for the one who does not.

Although the optimal outcome occurs when nobody defaults, the short term incentive to reduce debt causes one homeowner to default. If, instead, the first homeowner were to keep paying, the second could default to receive a positive payoff, causing the first to receive a negative payoff. Therefore, once one homeowner defaults, the second follows, creating a Nash Equilibrium in the bottom right corner of the payoff matrix.

This simple game theory model, which bears a strong resemblance to the prisoner’s dilemma discussed in class, helps show why so many people defaulted on their loans, causing the greatest financial disaster in recent years.

Sources

http://www.bankrate.com/finance/real-estate/strategic-default.aspx

http://rosskaplan.com/2010/03/the-prisoners-dilemma-real-estate-edition/