The Stock Market, the Internet, and the World

In the TED talk “How Algorithms Shape Our World,” Kevin Slavin, a researcher, entrepreneur, and “algoworld expert,” argues that the world we live in is run and shaped by algorithms which require very little, if any, human intervention. When this talk was first released a few years back, another student commented on how these algorithms make the stock market more complicated than it appears when simply analyzed by game theory. While the implications algorithms have on the virtual network of the stock market and other networks like it are undeniably interesting and important, I was more fascinated by the implications the physical system that underlies the stock market, that is, the Internet, has on algorithms, the stock market, and the world as a whole.

(12:05)

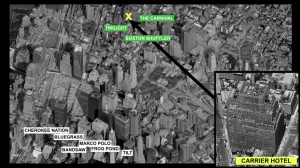

During one of the first lectures on graph theory, we discussed the physical network of the very first Internet, the ARPANET. That network was simple enough; the Internet was specifically located at certain research institutions and connected only between those locations. Today, with the vast, distributed nature of the Internet, I find it much more difficult to conceptualize the fact that the Internet is located in precise locations, such as the Carrier Hotel in New York. Even though it’s completely unrecognizable for the average user, our distance from the physical location of the Internet affects how quickly we can carry out Internet-dependent tasks, and for stock-trading algorithms, a few microseconds are all it takes to separate a winner from a loser. In the above picture, for example, someone from Marco Polo is eight microseconds slower than the Boston Shuffler algorithm based on location alone. The need for speed generated by the rise of algo trading, the use of algorithms to carry out stock market transactions, alters not only human presence in the virtual world of trading but also in the physical one, as skyscrapers near Internet hubs are hollowed out to make room for algorithms.

(13:16)

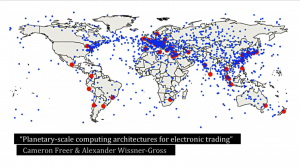

Networks are more than a theoretical concept that applies only to the virtual world, and Slavin’s TED talk solidified that fact for me. Our world will change as we search for the most efficient path through the Internet so we can send our best response strategy in the form of an algorithm to Wall Street and hopefully make a profit. Researchers at MIT predict the most effective network for stock traders (red) to make money is to place servers (blue) around the globe, even in the middle of the ocean. These theoretical yet highly plausible alterations to our world are a result of the strength of a single network and its influence over almost everything we do. I wonder how other networks, both physical and virtual, shape our lives today and expand our vision for a brighter, more efficient tomorrow.

Sources: http://www.ted.com/talks/kevin_slavin_how_algorithms_shape_our_world#t-496066 (pictures and information)