Market Clearing Prices in the Mobile Market

As the mobile phone market becomes more and more competitive, consumer behavior in the market becomes harder to predict. More consumers are choosing smartphones over regular phones, and more manufacturers are striving for better mobile performance. So with multiple options, what type of phone will each consumer choose, and what are the natural prices within the market?

If we model the market as a matching between buyers and sellers, we can determine relative pricing of products. In the current mobile market, there are a few obvious sellers. Apple has a large market share, at about 19.6 percent. Phones with the Android operating system, primarily developed by Google, have a 68.1 percent market share. There are some other smartphone operating systems, but their market shares are below 5 percent, so for the sake of simplicity in our model, we’ll neglect these sellers.

The buyers represent a much larger challenge if we want to model them as nodes. We need to put consumers into different groups, so we’ll consider the goals and desires of different consumer groups. One of the more interesting phenomena is the large market share maintained by Apple. Many of Apple’s customers have strong brand loyalty, which can be seen in the rush of preorders and purchases when a new Apple product is released. When the iPhone 5 was officially announced, there were around 2 million pre-orders in the first 24 hours. Obviously, there is a huge group of consumers that have a love for Apple products. So we’ll think of one group of consumers as those that have an intense brand loyalty to Apple. Another obvious seller is the Android operating system, so we’ll examine the consumers that would choose Android over the Apple iOS. One of the strongest principles behind the iPhone is the strict integration of hardware and software. Android, on the other hand, runs on a variety of devices. Hardware variety provides a huge flexibility for consumers. Android offers both bargain smartphones and phones with top of the line hardware. Since such a variety of manufacturers use the Android operating system, new hardware comes out for Android phones much more frequently. So consumers looking for top of the line hardware often buy Android phones. Additionally, Android hardware manufacturers often have multiple models with different performance specifications, while Apple only carries 1-2 similar phone models. Our third consumer group knows very little about smartphones. These consumers often make purchases based on feature values. For example, if a consumer wants to buy a smartphone that has access to the internet, e-mail, text messages, and phone calls, they are going to want these features at the lowest price possible. In this respect, Android has a significant advantage, because of hardware flexibility. Consumers that want a basic smartphone can pay for lower quality hardware that features the Android operating system instead of paying for the higher-end Apple hardware. There are some smaller consumer groups that use other operating systems, but judging by their market shares, these consumers are insignificant in our model.

So the overall formulation has 4 buyers, which are consumers with Apple brand loyalty, consumers that want the best possible hardware, and consumers that know little about smart phones. As mentioned before, there are also 3 sellers, which are Apple, Google, and non-smart phone manufacturers. So if we arrange the sellers and buyers as nodes, it looks like this:

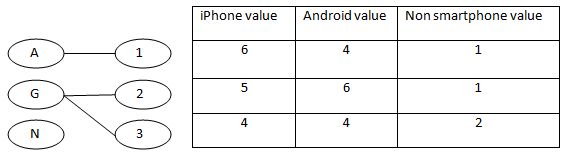

Where seller A is Apple, seller G is Google, and seller N is non-smartphone manufacturers. Buyer 1 is a group of consumers with Apple brand loyalty mentioned earlier, buyer 2 is a group looking for the best possible smartphone performance, and buyer 3 is a group with little knowledge of smartphones. In order to find a reasonable matching between these nodes, we need to find market clearing prices for the seller and buyer model.

Buyer 1 has an intense Apple brand loyalty, so his value of an iPhone is highest. His value for A, G, and N respectively will be (6, 4, 1), based on the fact that they have a higher value for Apple products but would also prefer a smart phone over a non-smartphone. For buyer 2, his value for an Android device will be higher than the iPhone, because that consumer desires better hardware. So his values will be (5, 6, 1). The value for the consumers that don’t know much about smart phones is (4, 4, 2). This consumer isn’t too familiar with the differences between Apple and Android products, and since we haven’t factored in price at this point, the values of the iPhone and Android devices are the same. So with added values, the matching looks like this:

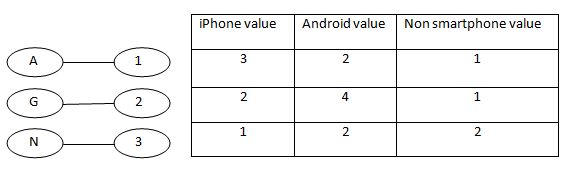

Our goal in this process is to form market clearing prices, and this set of values does not form an appropriate matching. In the mobile market, different phones obviously have different prices, so when adding prices to our model to try and form an appropriate matching, we are also forming a more accurate model of the market. After all, the consumer that knows little about smartphones is much more likely to be swayed by price than the the other two consumers that are looking for a premium brand or premium hardware. So, to form a more accurate model and resolve the mismatching, we’ll increase the price of Android devices by 2 units, and iPhone prices by 3 units. In the real smartphone market, the Apple iPhone is a bit more expensive than phones with comparable hardware and software capabalilties, so adding this increase in price to our model makes sense. The new values for each consumer are:

Now, there is a perfect matching, so the current prices are market clearing prices. Not only are these prices helpful for our model, they also accurately portray the mobile market. In general, the iPhone is more expensive than the average Android device, and non-smartphones are even less expensive. However, the smartphone market becomes more and more crowded each day, and as a result, more complicated. For example, HTC recently revealed the Windows Phone 8x and 8s. With more sellers than buyer groups, our model breaks down, but we can still examine how our three buyers would approach a broader phone market. The consumer with Apple brand loyalty would still buy an Iphone, but the other two consumers have a more complicated decision to make, which depends on the hardware that Windows phone will be offered on. In order to appeal to the other 2 sellers, it needs to be offered on both higher end hardware and low priced hardware, in order to appeal to both experienced smartphone users and bargain shoppers. Once the Windows phone is more integrated with the cellphone market, we’ll see how their market share develops. If the Windows operating system proliferates, it’s likely that they’ll take a portion of the Android market share instead of from Apple, because the Windows Phone operates on the same hardware flexibility principles as Android. However, taking a share of the market from a well-established operating system with a solid application library will be a hefty challenge.

Sources: http://www.engadget.com/2012/09/19/windows-phone-8x-by-htc-hands-on-microsofts-modern-mobile-os-p/

http://www.engadget.com/2012/09/17/iphone-5-pre-orders-crack-2-million-in-first-24-hours/

– Castor Troy